Opinion & Analysis

Advertisement

Advertisement

Advertisement

Latest News

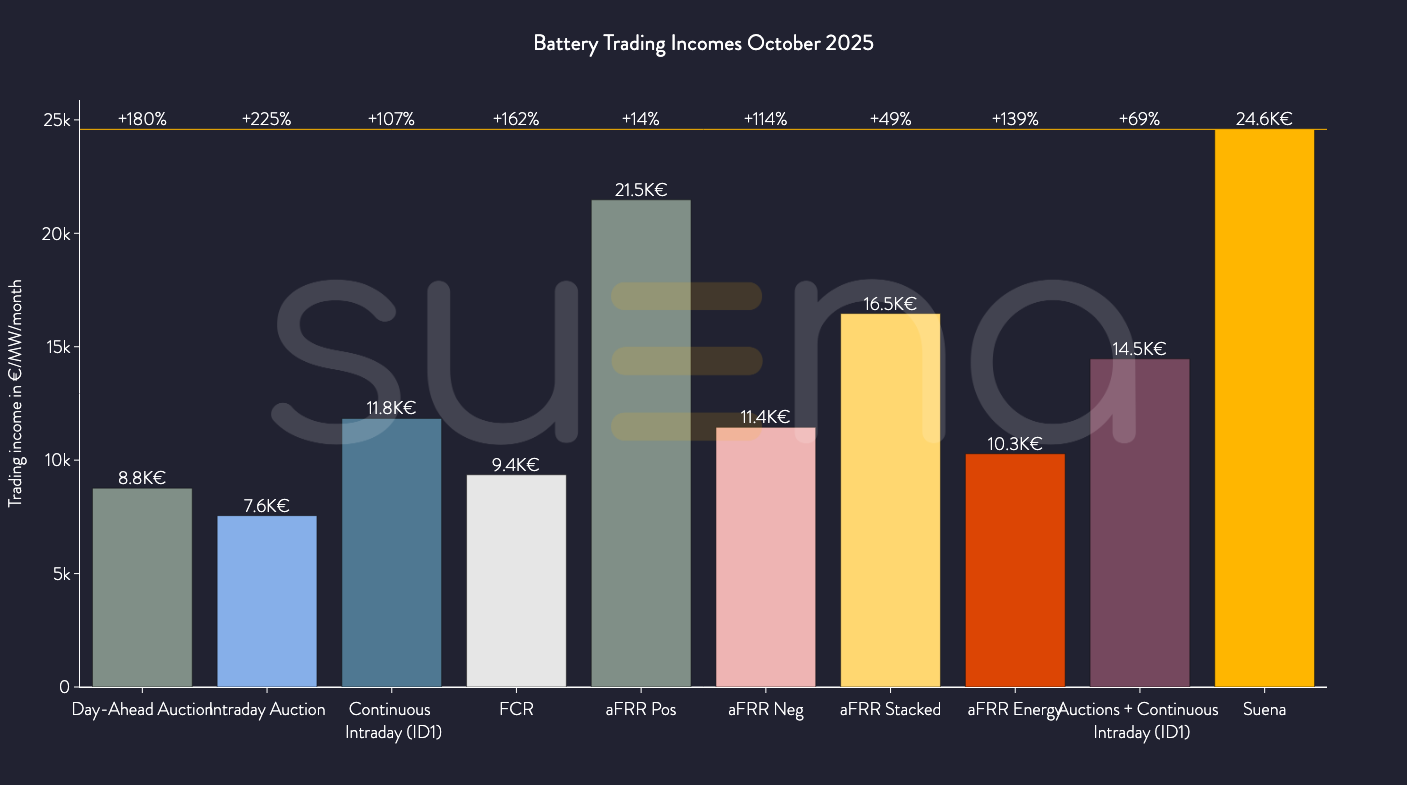

Stacking value in a changing market: BESS revenue in October

October brought a fundamental shift to battery trading dynamics In Germany as the day-ahead market switched from hourly to 15-minute intervals. Lennard Wilkening, CEO and Co-Founder of suena energy, breaks down how this structural change, combined with shifting weather patterns, reshaped revenue opportunities – and why tactical responsiveness across markets will only grow in importance as winter volatility sets in.

Nov 28, 2025

Advertisement

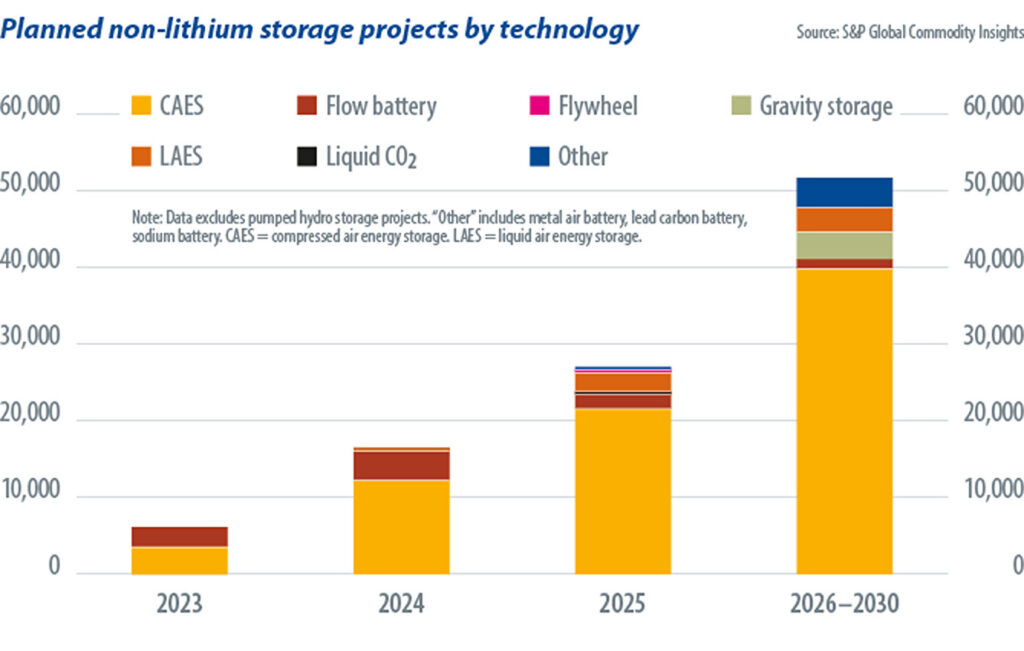

Shifting global battery storage trends could open the door for European growth

Global investment in battery energy storage systems (BESS) is entering a new phase, moving from niche pilot projects to large-scale grid integration. Europe’s ability to translate lessons from the United States – in policy clarity, contracting, and hybridisation – will define how quickly the market reaches maturity, NORD/LB experts write.

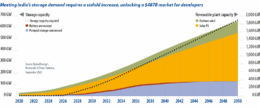

Battery boost needed to solve India’s energy gridlock

India has made significant strides toward its goal of achieving 500 GW of non-fossil fuel generation capacity by 2030. However, this progress could be undermined if more focus is not placed on the integration of renewables. Rystad Energy analyst Uttamarani Pati examines India’s progress on storage and transmission upgrades.

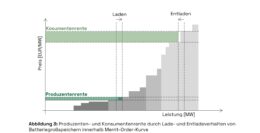

Stable, not volatile: How battery storage shapes electricity prices

The energy transition is facing a new challenge: rather than being determined by the total amount of energy generated, supply security is now dependent on its flexibility. The availability of electricity increasingly depends on when and where it is fed into or extracted from the grid, rather than on its overall production alone, writes Philipp Merk, founder and managing director of Kyon Energy.

All Opinion & Analysis news

Global battery market glut: Will oversupply benefit India’s 1 GW/4 GWh ESS tender process?

Oversupply in the global battery market is likely to influence the price discovery of a major tender process in India for 2 GW solar with 1 GW/4 GWh ESS, writes Ali Imran Naqvi, executive director (ED), Gensol Engineering Ltd.

Battery storage on a capacity market

In Germany – but not only there – there is a heated debate about the pros and cons of a capacity market. The German Renewable Energy Association is against it, and recently the German New Energy Industry Association, the DIHK and the EEX energy exchange have also taken a clear stance: Germany does not need a “power plant subsidy program.” In this article, four experts explain why battery storage can also play an important role in a capacity market and make recommendations on how the design of the market can help avoid mismanagement, wrong incentives and unnecessary costs.

Advertisement

Tesla continues scaling up energy storage business in China

The announcement of Tesla's battery factory in Shanghai marked the company's entry into the Chinese market. Amy Zhang, analyst at InfoLink Consulting, looks at what this move could bring for the US battery storage maker and the broader Chinese market.

Tackling merchant risk – A deep dive into Europe grid-scale energy storage contracted revenue

Current market conditions are propelling grid-scale project deployment in a more diversified European energy storage market. Anna Darmani, principal analyst – energy storage EMEA, at Wood Mackenzie, examines revenue streams in different parts of Europe and emerging routes to the market.

How grid operators and renewable energy producers can use batteries to develop a flexible energy system

As the urgency of mitigating the impacts of climate change intensifies with each passing year, it is the collective responsibility of grid operators and renewable energy producers to spearhead the transition to a renewable energy system.

Advertisement

China’s battery price war catalyses global energy storage innovation

The plummeting costs of energy storage, driven by China’s relentless price war, are expected to catalyse more economic deployments worldwide. Lithium iron phosphate (LFP) batteries are surging in market share due to their lower costs and higher cycle life compared to nickel-based lithium-ion batteries.

The prospects for battery investment in Germany

Merger and acquisition (M&A) activity has been heating up in Germany but increased competition and high interest rates are affecting renewables project values. Baris Serifsoy, partner at GreenCap Partners, examines the investment landscape in one of the world’s most developed PV markets.

Advertisement