Perspective on flexibility: How batteries, demand response, and interconnectors are powering a new grid

The growth of renewable energy sources (RES) is driving a pressing need for flexible loads and storage. At the same time, the corresponding retirement of baseload nuclear and coal assets increases the need for flexible deployable assets in times of low renewable energy generation.

Methods to manage the increased flexibility needs are batteries, interconnectors, demand/price-responsive load measures, and gas-fired power generation, with the possibility of green hydrogen generation as well. However, their deployment and scaling takes time and will not remedy the short-term flexibility needs sufficiently. But some measures can partially address these short-term gaps, such as building new renewable capacity directly with storage, leveraging existing grid connections to deploy batteries into the system faster, along with installing flexible backup generation.

Renewable energy oversupply

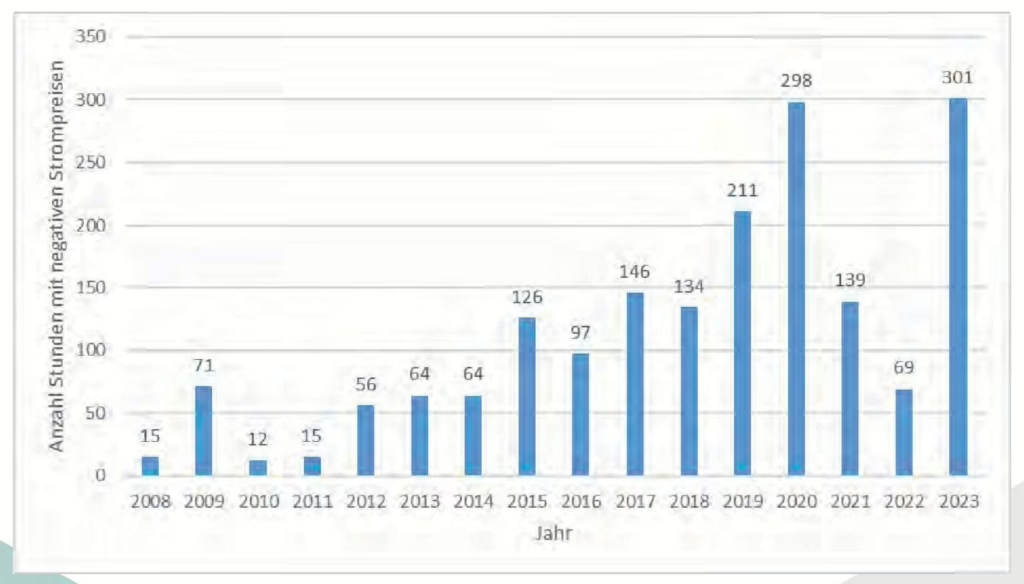

The massive growth of wind and solar resources and the corresponding oversupply, especially during midday hours, is resulting in an increasing number of hours with negative prices, as, contrary to traditional generators, RES assets generally do not respond to market price signals.

The number of hours with negative prices has increased from around 50 hours between 2008 and 2014 to between 100 and 200 hours from 2015 to 2023:

In addition, it has resulted in increasing compensation payments to RES operators to shut down their renewables assets that have reached the order of EUR 1 billion per year as of today.

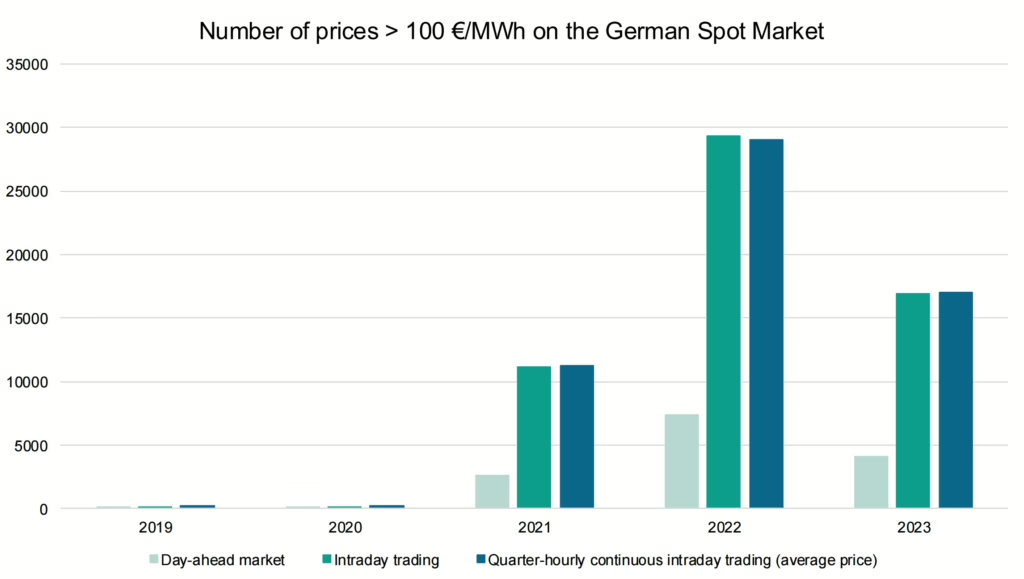

On the other hand, the lack of sufficient backup baseload and flexible capacity to balance times of low RES generation leads to increasing price spikes in the short-term wholesale and reserve markets:

These two effects together have massively increased short-term price volatilities both in terms of price spreads between Day Ahead, Intraday and Reserve markets as well as in daily and intra-daily peak-to-trough spreads:

As every coin has two sides, the increasing flexibility needs are creating not only the need for regulatory-driven business opportunities, such as flexible dispatchable backup generation, but also commercial business opportunities, especially for flexible loads and storage that are economically viable, stand-alone/without financial support.

Core flexibility providers

Batteries are the most universal flexibility providers as they can take advantage of both sides of widening price spreads during the day: When prices are low, they charge, when prices are high they discharge and they can run multiple cycles per day. In addition, they can be deployed before and behind the meter and thereby cater to different needs.

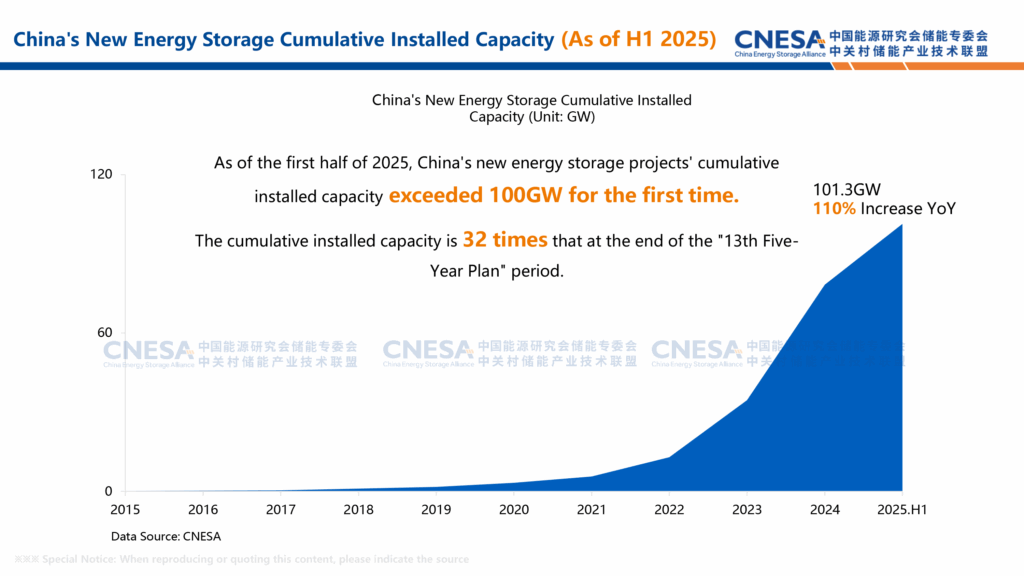

Battery costs have already come down significantly in the past few years and are most likely to continue on that trajectory, experiencing the same cost-curve decreases as seen in various renewables technologies. This will foster their deployment and result in strong increases in storage infrastructure investments.

It is also often argued that these investments are not viable as they will become uneconomic when more and more flexibility is provided into the system. For example, Aurora forecast that the hours with negative price will decrease back to about 200 hours in 2030 and thereafter further decrease back to levels seen in 2010:

But from my/our perspective, that instead means that the surplus returns that early movers will experience, similar to what early investors in the early days, for example, offshore wind experienced, will come back to levels where Return on Invested Capital (ROIC) will get close to the Weighted Average Cost of Capital (WACC).

Interconnectors (including planned energy islands in the North or Baltic Sea) are another interesting flexibility (and baseload) provider as they leverage the differing weather and conditions across countries and regions. An exciting undertaking in this context are the Xlinks projects, which couple Morocco with Europe via thousands of kilometres of subsea HVDC cables. Morocco has among the best conditions for wind and solar resources globally, providing close to 20 hours of baseload generation, and coupled with large battery storage, also brings substantial flexible loads to Europe. A variety of similar projects is currently in planning, effectively building energy bridges between continents (similar to what has been the case for a long time for telecommunications and data).

Demand and price-responsive loads are, in theory, the easiest flexibility measures to implement: they require little investment and pay off more or less immediately. However, they require a real-time data/measurement infrastructure, especially in smart meters. Germany is hopelessly behind in deploying these which particularly hinders the deployment of demand management in the entire real estate sector. Another challenge for larger energy consumers is the present regulation, which favors large baseload usage (over 7000 TWh) rather than rewarding flexibility provision – to be fair, that regulation is currently under review to shift it towards rewarding flexibility provision and not baseload consumption.

Gas (green hydrogen) fired power generation has been for decades the method of choice for flexible backup capacity for peak generation. However, in the current more decentralized energy system and with the boundaries of decarbonization goals they face two challenges: they are not sufficiently utilized to be economic on a stand-alone basis – at least not in the required amount – and they have a foreseeable expiry date due to their CO2 emissions profile. The current solution seems is to enable new gas-fired power generation to be switchable to green hydrogen to be carbon-neutral. However, due to conversion losses, this will remain a very expensive choice for flexible dispatchable power generation and will require substantial subsidies to attract private players to build them.

So, in general, there are plenty of measures to increase flexibility in the system, and over time, perhaps by the early 2030s, sufficient flexibilty will be provided to the system. But what can be done to give more flexibility to the energy system in the short term?

Short-term opportunities

Couple the deployment of new wind and solar assets with storage: this is not only beneficial from a system perspective but also increases the economics for the individual assets via additional income streams by optimizing in short-term wholesale and reserve markets (especially if providing power to the system in times of negative prices is being penalized in the future)

Leverage existing but underutilized grid connections to build out batteries faster: Existing solar and wind assets and a number of industrial users have grid connections today that are largely underutilized. As the grid connection is already there, deploying storage at these sites will be much faster (permitting cycles for stand-alone storage assets are often two to three years) and, due to colocation, improve the economics of the batteries.

Scale up the flexibility solutions for SME, B2B and industrial users: By now there are a multitude of players in the market that optimize both internal and external power flows against market prices within the boundaries of electricity needs of the users. Faster scale-up of these solutions is hindered chiefly by a lack of awareness, along with a limited willingness to change established processes, and fear that the core business could be affected. Trying it out at one site typically alleviates all these concerns.

Increase speed of deployment of smart meters in the real estate sector: Enabling consumers to manage their loads depending on prices – a model common, for example, in the Nordics – is a very easy-to-implement measure with sizable impact. Some recent discussions to slow down the smart meter rollout are not exactly helpful to make this happen, as it will exclude a large share of the population.

About the author:

Sven leverages his 20+ years of experience and network in the global energy industry to invest in, mentor and kick-start early-stage startups, as well as advise more established players in the electrification ecosystem. He is an active partner at Vireo Ventures and a mentor at the Creative Destruction Lab and the Center of Entrepreneurship in Berlin. Prior to Vireo Ventures, Sven spent 20 years at McKinsey & Company in the global energy and materials practice, most recently leading the German and Japanese energy and materials practices. For the last 10 years, he built and led McKinsey’s global corporate strategy, finance and risk service line, working with numerous energy companies in Germany, Europe, the US and Japan. He was instrumental in designing and executing the transformation of German energy companies RWE, E.On, and innogy, as well as the transformation of Danish oil and gas incumbent DONG Energy into global offshore wind leader Orsted. In his last 5 years at McKinsey, Sven has focused on helping energy players transition to the „new energy world“ by digitizing their core businesses, building new businesses in renewables, e-mobility and hydrogen, and creating future bets by setting up innovation hubs, venture activities and partnerships.