Chinese energy storage manufacturers push back against cut-throat competition

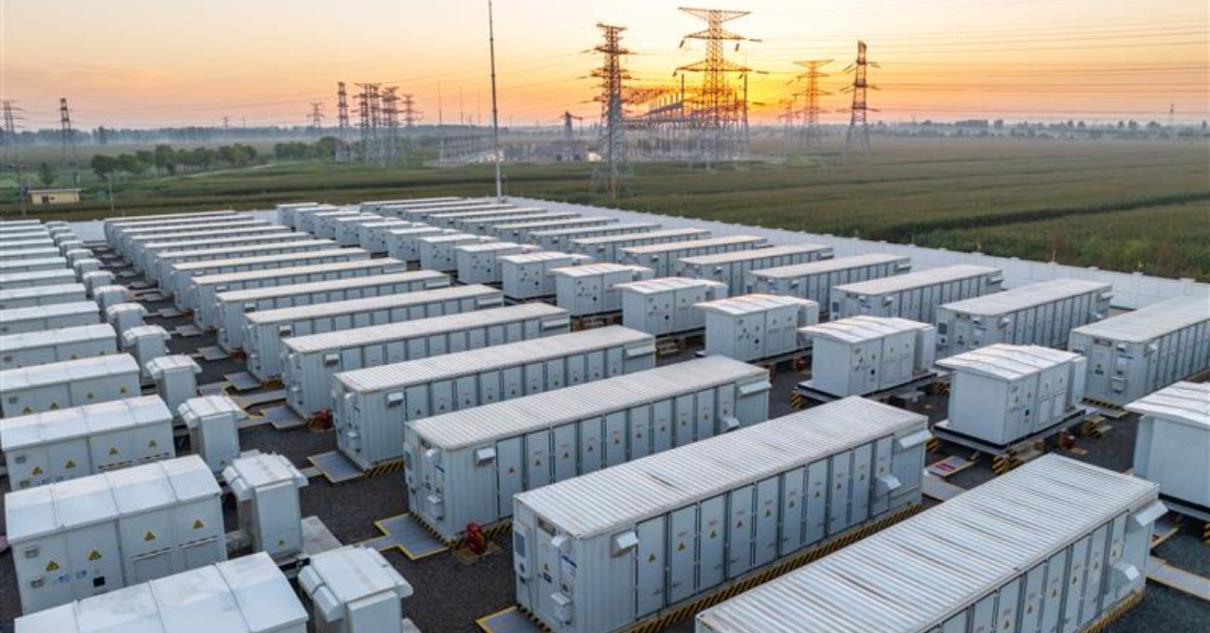

Oversupply and aggressive bidding in the energy storage sector have eroded margins, threatening the viability of numerous players. In response, new industry voices in China, the world’s energy storage manufacturing powerhouse, are advocating for price control, higher standards and reforms that will safeguard quality and ensure long-term stability.

At a recent meeting organized by the energy storage branch of the China Industrial Association of Power Sources (CIAPS) in Beijing, key industry reprensetatives noted that while China already dominates the global energy storage supply chain, fierce price wars fueled by “involutionary competition” are compromising safety and quality – and undermining national and industry interests.

Participants urged a transition from cut‑throat price competition to collaborative, innovation-driven value creation, aiming to build a fair market that supports the industry’s sustainable growth.

At the event, CIAPS unveiled a draft policy titled “Initiative on Maintaining Fair Competition and Promoting Healthy Development of the Energy Storage Industry.” The initiative spans cost and pricing behavior norms, contract performance, technological innovation and green development, and industry coordination.

A key section on pricing norms proposes that quotations be based on actual costs, operational conditions, technological capability, reputation, and project risk – discouraging irrational low pricing and preventing the “bad money driving out good money” dynamic.

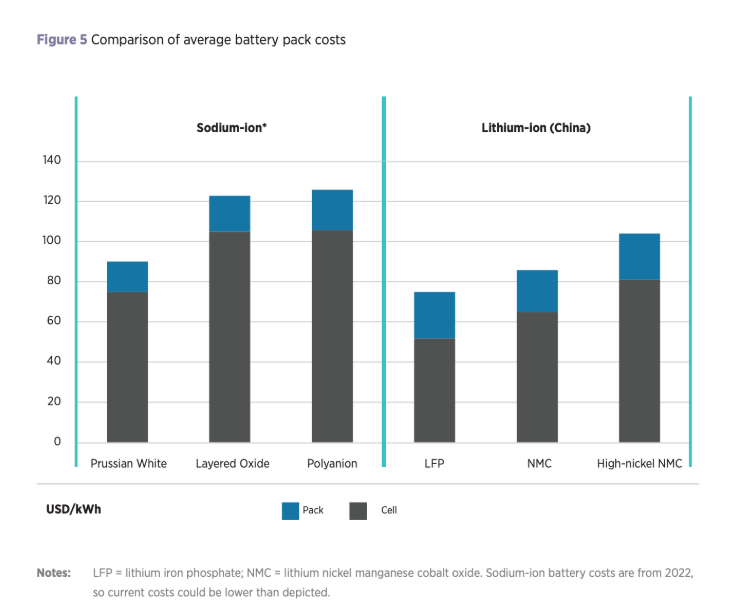

Recent tenders in China have reflected this pricing frenzy with average lithium-ion battery energy storage system-level bids coming in at around $65/kWh, startling Western markets. Despite these record lows, analysts predict continued declines in pricing through 2030.

The latest anti-involution initiative is currently open for public comment. Already, over 150 companies – ranging from lithium-ion, sodium-ion, and flow battery manufacturers to compressed air, thermal storage experts, PCS/BMS suppliers, system integrators, and safety-equipment and installation firms – have endorsed it.

This move follows a December 2024 closed-door seminar by the China Energy Storage Alliance (CNESA) to curb destructive competition. Earlier, at a July 2024 a meeting of the Political Bureau of the Communist Party of China Central Committee, central authorities emphasized the need for industry self-discipline and orderly exit paths for outdated capacity.

While still lagging by a few years, developments in the energy storage sector echo those in China’s solar industry – now shifting from rapid expansion to strategic consolidation, focusing on innovation, sustainability, and quality rather than aggressive pricing.