Ormat brings online 120 MWh Texas battery under seven-year tolling deal

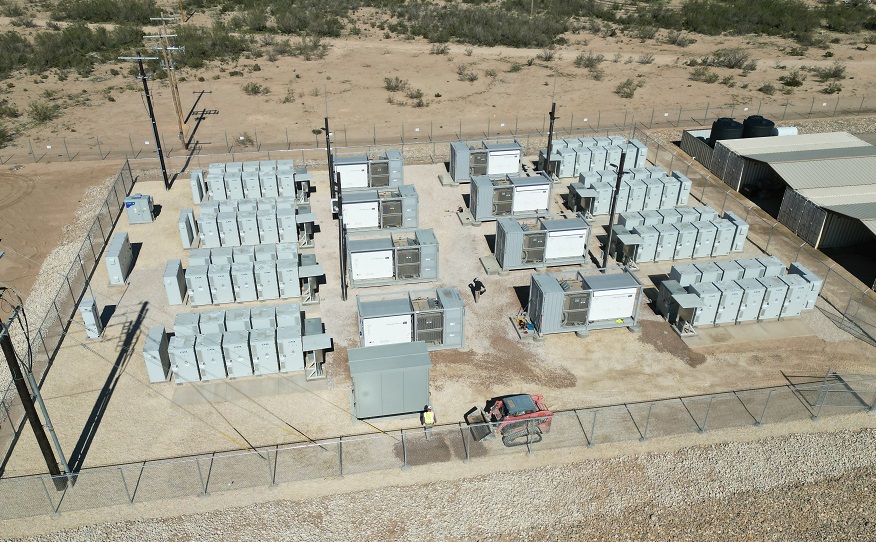

US-based renewables developer and geothermal energy specialist Ormat Technologies has commenced commercial operations at its Lower Rio Battery Energy Storage System (BESS) in Texas – its first tolled standalone storage project in the state.

The 60 MW / 120 MWh facility will deliver both energy and ancillary services under a seven-year tolling agreement, contributing to Ormat’s expanding US energy storage portfolio, now totaling 350 MW / 778 MWh of installed capacity.

Texas has long been one of the most attractive markets for grid-scale battery storage in the US, thanks to its energy-only market structure and growing share of intermittent renewables. However, a steep decline in revenues from both energy arbitrage and ancillary services over the past year has raised questions about whether the state’s battery market is approaching saturation.

Analysts suggest that the sector may be entering a new phase – not of decline, but of maturing – where success depends increasingly on secure offtake structures and advanced trading strategies. Tools like tolling agreements are becoming more prevalent, offering revenue certainty that supports bankability and project financing.

Under tolling agreements, the offtaker pays a fixed fee in exchange for full operational and trading control of the battery system—reducing merchant exposure for the asset owner and making debt financing more feasible.

Ormat brings significant experience in tolling-based energy storage, recently securing two 15-year fixed-price agreements for a combined 300 MW / 1,200 MWh in Israel. The projects, awarded through a competitive tender by the Israeli Electricity Authority, are being co-developed with local partner Allied Infrastructure Ltd., with each party holding a 50% stake. These represent Ormat’s and the partnership’s first major foray into the Israeli utility-scale storage market.

In support of the Lower Rio project, Ormat also closed a hybrid tax equity partnership with Morgan Stanley Renewables Inc., enabling it to monetize the 40% Investment Tax Credit (ITC) available for the facility. The deal generated approximately $25 million in proceeds, advancing Ormat’s broader target to monetize $160 million in tax benefits during 2025.

Ormat’s current generating portfolio stands at 1,618MW, including a 1,268MW geothermal and solar generation portfolio that is spread globally in the U.S., Kenya, Guatemala, Indonesia, Honduras, and Guadeloupe. Its 350 MW energy storage portfolio is located in the US.