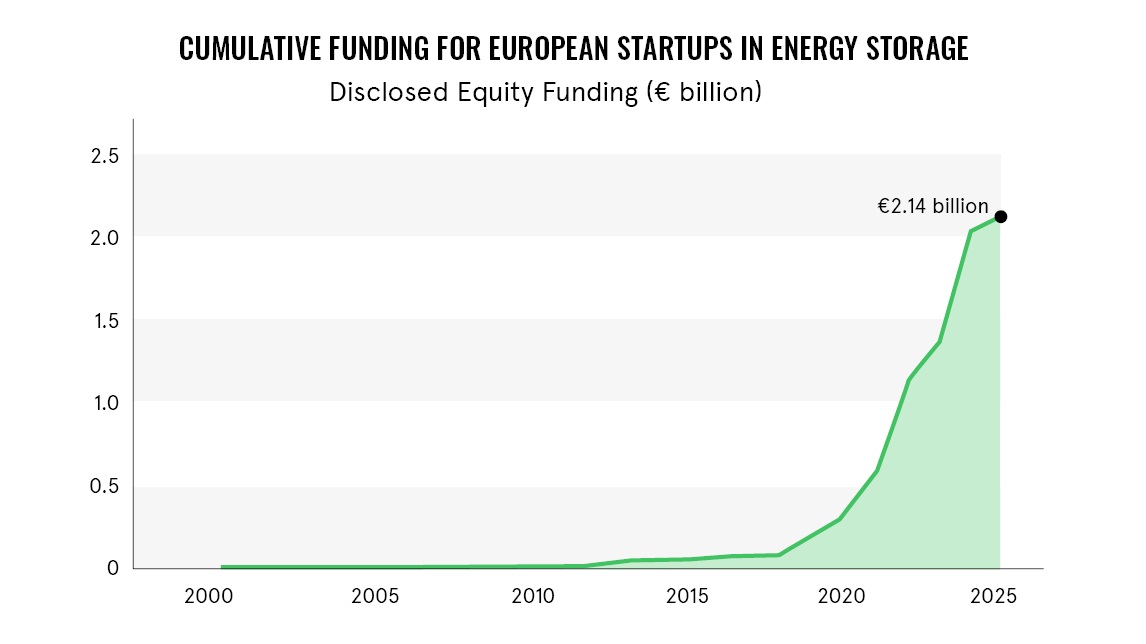

Funding for European energy storage startups reaches €2.14 billion

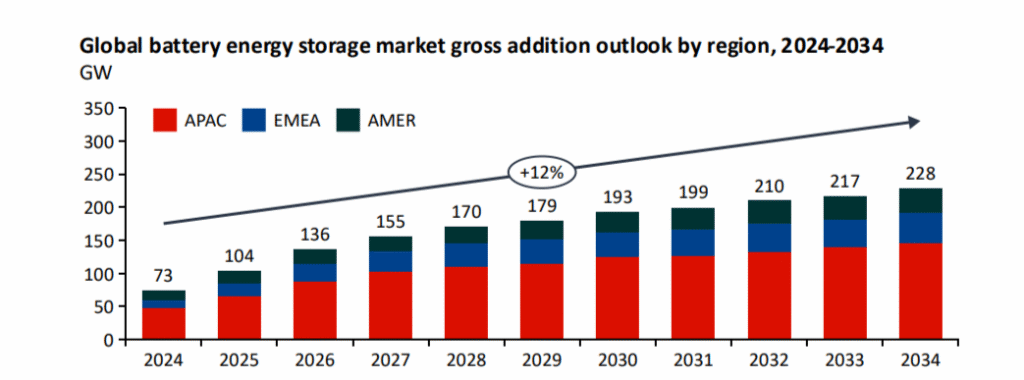

As energy storage becomes increasingly vital for renewable integration, grid resilience, and energy security, investors are ramping up support for technology developers. While China continues to dominate manufacturing, European energy storage companies are steadily attracting growing investment and attention.

The analysis by Belgium-based Avnet Silica, the European semiconductor specialist division of global technology distributor Avnet, finds that total equity funding for European startups manufacturing energy storage hardware (for commercial, industrial, and grid-scale applications) has topped €2.14 billion. Nearly 47% of this funding was raised in the past three years, and 84% in the last five, highlighting the sector’s rapid acceleration.

The analysis reviewed all European energy storage companies listed in Crunchbase as of 22 September 2025, focusing on startups producing hardware for commercial, industrial, and grid-scale applications, including supply-chain and manufacturing support. Software-only companies were excluded unless tied to hardware production, such as BMS or testing tools. Reported equity funding includes seed, angel, VC, private equity, and corporate rounds, excluding crowdfunding, grants, debt, and IPO/post-IPO funding.

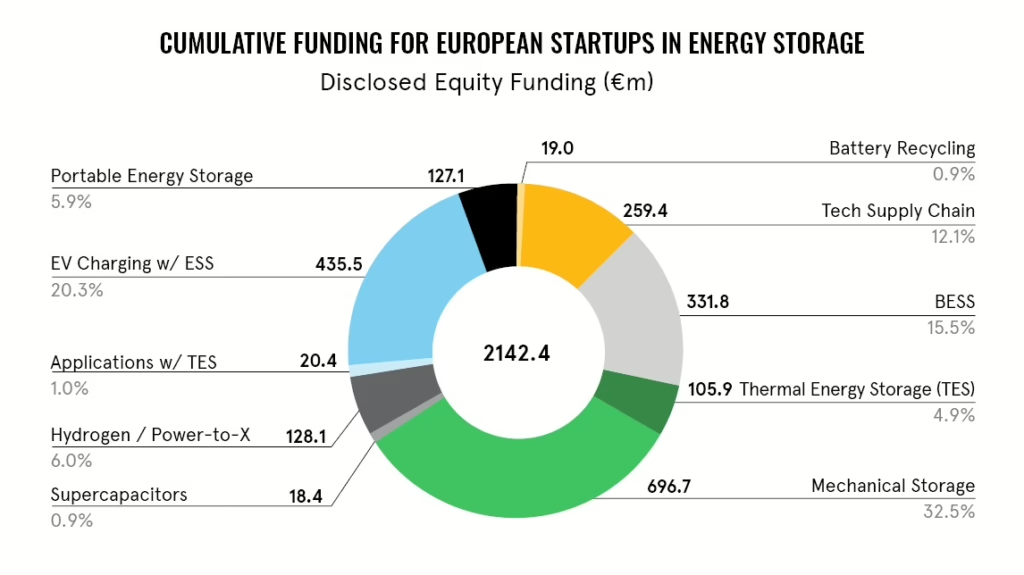

Among battery energy storage systems, the bulk of private funding—€236 million—has gone to lithium-based technologies, with €221 million for lithium-ion and €15 million for lithium-sulfur batteries. Mechanical storage, despite fewer companies, has captured the largest share of equity funding at €696.7 million, more than double that of battery energy storage systems (€331.8 million).

Thermal energy storage startups have raised €105.9 million, split between sensible heat storage (€80.4 million) – using materials like glass, ceramic, rock, gravel, or salt – and latent heat storage (€24.5 million), based on phase-change materials. Specific applications integrating thermal energy storage have garnered €20.5 million, including industrial heat pumps (€4.9 million), solar-plus-TES systems (€1.1 million), and refrigeration (€14.5 million).

Other areas of energy storage funding include supercapacitors (€18.4 million), hydrogen storage (€73.7 million), and power-to-X solutions (€54.4 million), where hydrogen and power-to-X serve as energy storage rather than solely fuel production. Startups offering EV charging with integrated energy storage for off-grid, remote locations or high-power buffered charging have received €435.5 million.

Portable energy storage solutions serving events, construction sites, and other temporary applications have raised €127.1 million across three European startups. Supply-chain-focused companies have attracted over €259.4 million, with the majority directed to next-generation battery chemistry (€113.2 million) and cell/module/pack production (€89.0 million).

Circular economy initiatives are also gaining support, with Luxembourg’s Circu Li-ion raising €4.5 million and Germany’s tozero securing €14.5 million for battery recycling. Additionally, 14 battery energy storage startups are incorporating second-life batteries into their products, either exclusively or as an option, further promoting sustainability in the sector.

While several well-established players continue to lead the energy storage sector, startups are increasingly stepping in to tackle a wide range of industry-specific challenges. “There’s the challenge of EV charging in locations that can’t be easily powered by the grid. There’s a need for portable energy in temporary locations, such as events and construction sites. There’s a demand for industrial heat, which largely relies on fossil fuels at present,” said Harvey Wilson, senior manager for industrial vertical markets EMEA at Avnet Silica. He added that beyond battery storage, “there’s the issue of long-duration energy storage, the predominant solution for which is currently pumped hydro; however, other options are being developed and offered to the market as well.”

Wilson also highlighted the innovation coming from startups and major suppliers alike. “It’s also exciting to see startups focusing on the next-generation of materials, components and battery chemistry. The major suppliers of power electronics are also investing heavily in R&D, and we’re seeing lots of innovative technologies coming down the pipeline, enabling the next wave of power products, with higher performance and greater efficiency in energy storage, which will definitely be required if we’re to meet the demands of renewable energy, AI data centres, electrified industries, and our collective climate targets.”