Merchant risk and platform value: Batteries move to the core of the energy transition

As decarbonized, flexible systems continue to scale globally, battery storage is critical for more than just the transition to net zero. Growing demand for systems like wind and solar photovoltaics (PV) are necessary to ensure well-functioning power markets provide the independence, security and stability that global governments require. Investors in the sector face well-known challenges, including market fragmentation and merchant risk, but also newer ones such as supply chain volatility. Emerging strategies allow financial sponsors to create value through data-driven trading strategies and asset management, portfolio level financings and the adoption of hybrid contracting models.

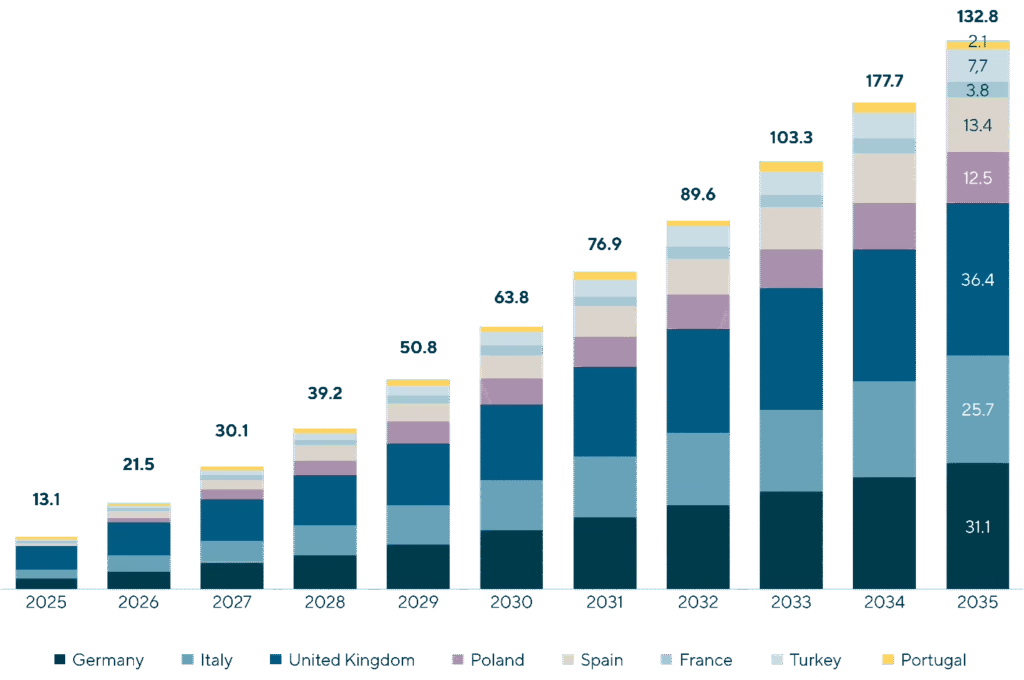

These nascent approaches and larger market trends are elevating batteries from tactical investments to the core of the energy transition investible universe. From 2020-24, total investment in European energy storage grew by more than 12.5 times. In comparison, total investment in European wind and solar projects grew by 1.4 times over the same period. Projections indicate that Europe’s battery energy storage capacity is set to increase fourfold by 2029. This massive expansion will be driven by regulatory support, technological advances and rising demand for grid stability. The market is shifting toward large-scale, integrated platforms that offer operational efficiencies, scalability and reliable revenue streams, reflecting investor priorities and the ongoing maturation of the sector.

Image: Bloomberg New Energy Finance European Energy Storage Investment, 2025

Macro drivers & policy tailwinds

The EU 27 and the UK are striving to reach climate neutrality by the middle of this century. The EU has committed to cutting 2030 emissions by at least 55% compared to 1990 and achieving net zero by 2050. The UK has gone further, pledging a 68% cut by 2030 and 81% by 2035 before reaching net zero in 2050. Germany has advanced its deadline to 2045, with steep interim reductions, while France and Italy follow the EU’s 2030 and 2050 milestones, with Italy aiming for rapid renewables growth despite its gas dependence.

Across Europe, the electricity generation sector is decarbonizing quickly, but rapid renewables deployment combined with limited load shifting infrastructure has meant some demand can only be met by conventional, fully dispatchable energy generation. The rise of AI has meant that the power required by data centers, which have a relatively flat intraday demand profile, is expected to rise from 96 TWh (2024) to 236 TWh across Europe by 2035. This 24/7 power demand cannot be met by intermittent renewables generation, creating further need for battery storage. The overarching trend is that while targets are ambitious and, in most cases, legally binding, implementation gaps remain significant, and the next decade will be decisive in accelerating infrastructure, investment and social support to keep net-zero pathways credible.

At the same time, several countries are commissioning or planning new gas-fired plants to back up renewables and ensure supply security, with Germany, the UK, Italy and parts of Central and Eastern Europe leading on new projects. Besides gas, a strategic set of nuclear projects are moving forward, notably France’s planned EPR2 fleet, the UK’s Hinkley Point C and Sizewell C and Hungary’s Paks II. However, several of these projects (including Sizewell C and EPR2) are not expected to reach commercial operation until the mid-2030s. Besides gas, a strategic set of nuclear projects are moving forward; however, several of these projects are not expected to reach commercial operation until the mid-2030s.

Overall, the coming decade will see Europe’s conventional generation shrink in carbon intensity: coal will largely disappear, gas will act as the transitional backstop and nuclear power will provide a long-term low-carbon baseload in the European jurisdictions where it is politically supported and financed. However, this additional nuclear capacity will not provide the necessary stability to the grid that traditional thermal plants and gas peakers do: stability will come in the form of batteries.

Incentivizing BESS developers

Europe’s renewable energy infrastructure faces what have now become well-known transmission and distribution bottlenecks due to aging grid systems. While generating nearly half of the EU’s electricity from renewables in 2024 was a remarkable achievement, grid constraints now threaten to limit progress and destabilize systems. Legacy power transmission and grid management systems were designed for steady, dispatchable generation close to demand centers, not intermittent generation from remote areas.

In April 2025, Spain experienced one of the most extensive blackouts in European history, with power supply dropping from 27 GW to near-critical levels in a matter of seconds. Two simultaneous disconnections of power plants triggered a rapid frequency drop, leading to a cascading failure across the grid. Although automatic protections were in place and initially activated as designed, the magnitude of the drop surpassed their capacity, causing a systemic failure. The sharp decline overwhelmed the system’s ability to maintain its standard frequency, causing an automatic shutdown of power stations. A critical factor exacerbating the situation was the insufficiency of primary reserve capacity.

In Spain, primary reserve services – essential for stabilizing the grid during sudden disturbances – are provided by conventional generators. The system was designed for a grid dominated by gas plants, which naturally provide inertia and frequency support. As renewables push these units out of the merit order, their stabilizing role has diminished. Moreover, Spain’s BESS capacity stands at a modest 60 MW, significantly behind countries such as the UK and Italy. This incident was a stark reminder that conventional generation assets cannot always be relied upon for grid balancing in a world of high renewables penetration. Transmission systems across Europe will require rapid voltage control and frequency response from battery storage if the continued buildout of renewable generation assets is to successfully continue.

Germany experienced 457 negative pricing hours in 2024 (+52% compared to 2023). In April 2024, Spain saw its first ever negative pricing, ultimately experiencing 247 hours of negative pricing across 2024. These trends have been magnified in 2025 and are expected to worsen across Europe over the coming years. Battery storage offers a solution to these negative pricing hours problems in these markets.

Current market reforms

Recent regulatory reforms in Europe have created sector-wide tailwinds, improving the bankability and inevitability of energy storage assets. Transmission system operators (TSOs) and distribution system operators (DSOs) are incorporating energy storage into long-term plans for acquisitions and revenue forecasting. Storage-inclusive tenders and capacity auctions are incentivizing the adoption of battery systems to align with renewable energy objectives. Consequently, grid operators and regulators across Europe are designing market incentives and programs to make storage attractive for private capital.

The UK offers both availability-based tenders (capacity reserved and paid) and energy payments. France’s multi-year capacity payments and tender awards give price certainty for BESS developers and the financial sponsors that back them. Germany’s frequency-based payments are attractive to batteries because of their predictable revenue; FCR pays for availability (capacity reserved regardless of energy dispatched), and aFRR mixes availability and energy balancing.

This combination of regulatory clarity, growing system demands and a range of investment opportunities across a broad spectrum of contracting structures makes BESS an increasingly attractive asset class for financial sponsors across Europe. Grid fee relief and capacity market reforms are transforming project bankability by aligning incentives with the operational value that batteries provide to local grids. BESS developers are now participating in ancillary service markets purpose-built for storage while leveraging structured incentives to align projects with regional energy objectives.

For financial sponsors looking for alternatives to greenfield wind and solar, battery storage complements other strategies, such as repowering older renewables assets. By providing an alternative cash flow and contracting profile to standalone wind and solar PV, as well as providing natural hedge against the increasingly common negative power prices, battery storage is a powerful tool for sponsors in the European market.

Outlook

As Europe accelerates toward net-zero target dates, improving overall grid reliability is crucial. Battery storage is emerging not merely as a complementary technology but as a cornerstone of the overall energy transition. Regulatory reforms, market maturation and private capital engagement are transforming BESS from a nascent opportunity into a scalable, investable asset class.

Ultimately, battery storage represents a dual opportunity: a reliable source of revenue in an evolving energy market and a critical enabler of Europe’s broader climate and energy goals, offering investors a front-row seat in shaping the continent’s clean energy future.

Lincoln is proud to serve as an active advisor for companies and sponsors navigating the exciting energy transition, and our team has completed more than 60 energy transition, power and infrastructure transactions in the last three years – including 24 in 2025 alone. Lincoln International’s deep sector knowledge and global reach enable energy clients to achieve their business positioning goals while receiving optimal transaction outcomes. As energy systems evolve toward volatility and decentralization, storage is no longer a complementary asset – it is becoming foundational.