Grid-scale

Advertisement

Advertisement

Advertisement

Latest News

Advertisement

German energy company moves ahead with 800 MWh battery storage project

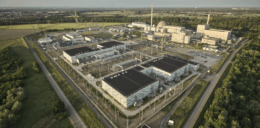

Energy company Energie Baden-Württemberg AG (EnBW) has announced its large-scale battery storage facility, to be built at the site of a former nuclear power plant in southwestern Germany, will be developed without government subsidies.

Germany to remove large battery storage systems from grid connection ordinance

Following a surge in battery storage applications, Germany’s Federal Ministry for Economic Affairs and Energy is planning to remove storage systems from a rulebook overseeing the grid connection of power plants larger than 100 MW. The move has been criticized by the German Renewable Energy Federation.

India’s Oriana Power explores compact pumped storage for C&I customers, raises BESS target to 20 GWh by 2030

Oriana Power is expanding its focus beyond battery energy storage to compact pumped-storage solutions – a new generation of systems that the company believes could redefine the future of commercial and industrial (C&I) energy management.

All Grid-scale news

5 GW of grid-forming batteries and synchronous condensors to underpin transition for network operator TransGrid in Australia

Transgrid, Australia's largest electricity transmission network operator, working in the state of New South Wales, has chosen grid-forming batteries and synchronous condensors as its preferred system strength technologies to support the grid.

Advertisement

BBDF 2025: Challenges and prospects in Italy, Europe’s hottest storage market

Italy is currently among Europe’s hottest battery storage markets thanks to its MACSE auction scheme, an established capacity market and the first attempts to go merchant by project developers. This market, however, is becoming increasingly competitive and both micro and macro challenges are arising.

BBDF 2025: Merchant vs. contracted strategies

The 'Revenue models and market perspectives across Europe' discussion panel has delved into Europe’s hottest market showing how diversified and complex the current and future scenarios can be. The discussion also highlighted that, despite strong appetite from investors and a significant range of business models, lenders remain very cautious when it comes to risk hedging.

Advertisement

Advertisement