Evaluating the profitability of vanadium flow batteries

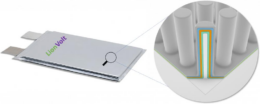

Vanadium flow batteries are one of the most promising large-scale energy storage technologies due to their long cycle life, high recyclability, and safety credentials. However, they have lower energy density compared to ubiquitous lithium-ion batteries, and their uptake is held back by high upfront cost.

Now, researchers led by the University of Padua in Italy developed a techno-economic model, using experimental and market data, which can better inform investment decisions for this type of technology.

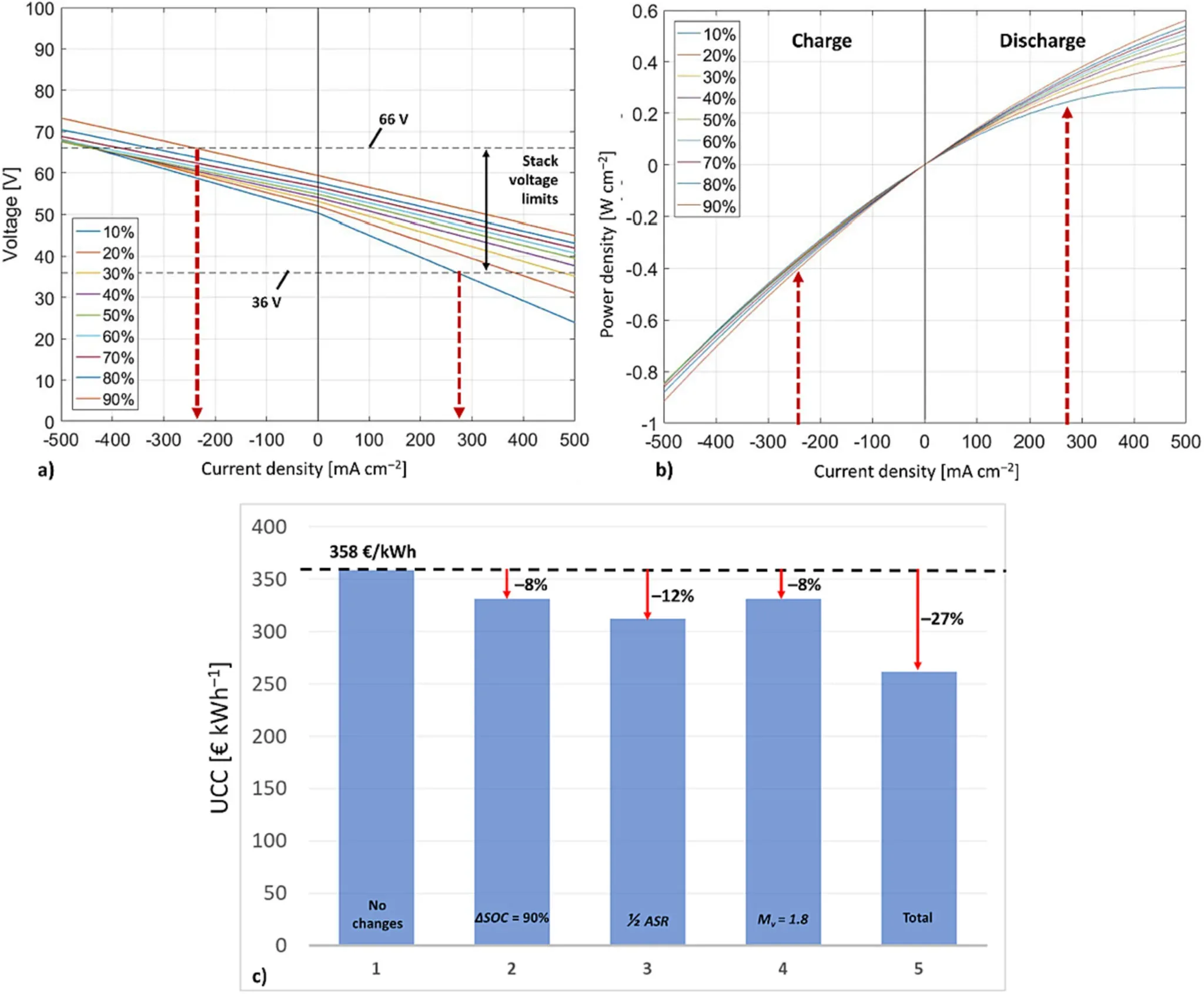

Their model considers the present and future competitivity of industrial flow batteries in operating specific services, which have not yet been developed to an accurate grade, and yields economic performance indicators such as capital costs, operative costs, levelized cost of storage (LCOS), and net present value.

Parameters from large-area multi-cell stacks

To perform their calculations, the researchers used technical parameters taken from large-area multi-cell stacks, rather than from small single-cell experiments, to better characterize the behavior of real industrial-scale systems. They also used data from real financial markets and economic patterns of some major manufacturers.

The assessment was performed considering a lifespan of 20 years with a charge/discharge cycle per day. Each component affecting the capital and operative costs was analyzed, and the impact of side phenomena on capacity losses was considered.

As a result, their model showed where the economic indicators are heading and which parameters have a greater affect on investment profitability, thus tracking a possible roadmap for system optimization.

Capital costs could come down to €260/kWh

Their estimations indicate that technological and market evolutions are heading to much more competitive systems, with capital costs down to €260 ($284.2)/kWh at an energy/power duration of 10 hours. Namely, this is the breakeven point where the present values of total costs equate the present values of total revenues and no economic result is obtained.

“This is to be compared with a break-even point in the net present value of 400€ kWh, which suggests that flow batteries may play a major role in some expanding markets, notably the long duration energy storage,” the researchers stated.

Their results are published in the study “Techno-economic assessment of future vanadium-flow batteries based on real device/market parameters,” which was recently published in Applied Energy.