Interview with Trina Storage: We expect consolidation in the coming years

Trina Solar is a well established solar panel maker which is aiming to diversify its production activities and increasingly investing in other businesses. Why is that?

While we started as a solar module manufacturer, we have long since evolved into an integrated provider of smart energy solutions. Creating a new energy world and promoting clean energy for all is the company’s mission.

We leverage the experience, expertise and financial support of 27 years of module business to continuously develop new lines of business. We have been developing projects for over two decades. In 2018, Trina entered the smart tracking and mounting systems business. It laid the foundation for its energy storage business back in 2015. We have invested in vertically integrated manufacturing sites in China that will enable us to produce over 20 GWh of Trina-owned battery cells for the non-EV battery market, starting this year.

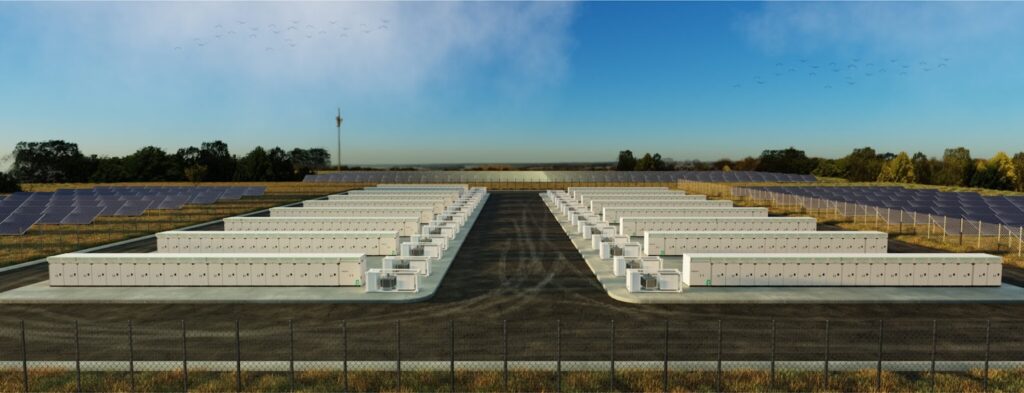

We currently provide vertically integrated containerized DC storage systems and fully integrated AC solutions. Other new and upcoming businesses include hydrogen equipment and Energy Internet of Things.

How would you describe the current state of play in the upstream battery energy storage system (BESS) industry?

The current environment in the BESS market is best described as fierce competition. Both established and new technology providers are positioning themselves in a growing number of markets. Trina Storage has gained experience in the European market over the past few years. We started actively selling to the UK around three years ago, with smaller projects and integrating third-party equipment. This has enabled us to build local engineering capabilities in Europe, as well as regional technology partnerships, for example for power conversion system supply.

On the manufacturing side, we are now rapidly ramping up our vertically integrated factories. The fact that Trina Storage manufactures its own battery cells and modules is what differentiates us from other market players who act as mere integrators of third-party components. Vertical integration, from cells to switchgear and AC solutions, puts us in an advanced position in terms of end-to-end quality control and performance, as well as competitiveness. Despite growing demand, we currently see global production capacity and product variety outpacing demand. We expect the market to consolidate in the coming years.

What do you expect in terms of battery prices in the coming years?

Production levels are now sufficient to avoid a price crisis like the one we had two years ago. In fact, there is enough available capacity to push prices down in 2024 in an abnormal way. Eventually, we expect prices to return to a natural downward curve related to technology, production scale and the evolution of raw materials, rather than sharp price drops due to strong competition as we are experiencing now.

Do you also see increased competition from other battery chemistries and storage technologies?

Technology developments are happening very quickly in the BESS space and Trina Storage has a strong R&D team that is constantly looking at a variety of future technologies, some more exciting than others. For the foreseeable future, however, we believe lithium iron phosphate (LFP) will continue to be the dominant battery storage technology. In fact, it is expected to expand and be competitive at least in the 4-8 hour range.

There is still a lot of room for improvement in the energy density of current LFP technology. For example, Trina Storage has developed 530 Ah cells in a similar form factor to the previous generation 306 Ah, which will enable a 7 MWh BESS system to be built inside a standard 20 ft container in the near future. Overall, looking at the bigger picture, other technologies will certainly play a role for long-duration or seasonal balancing.

What are your views on the Italian energy storage market?

Italy is set to become one of the leading European markets for utility-scale storage. Referring to the Terna 2023 plan, the total installed energy storage target is 22.5 GW by 2030, or about 70 GWh in terms of capacity, of which 11 GW is utility-scale BESS. This plan will be strongly influenced by the actual rate of renewable energy deployment in the electricity system, which in turn will create the need for grid-scale projects. To date, the renewable energy system expansion targets include 80 GW of solar PV (+57 GW vs. 2021) and 28 GW of wind (+17 GW vs. 2021). We expect the deployment of utility-scale BESS to be mainly driven by the capacity market and the MACSE (Electricity Storage Capacity Procurement Mechanism) at least in the coming years.

We see a limited scope for BESS projects outside the capacity market or MACSE auctions. A predominantly merchant business model implies uncertainties and unstable revenue streams that few banks or investors are willing to accept, at least in the early years. Colocation projects (e.g. solar + storage) are one option, but this would also likely require new legislation with a strong incentive scheme in the future.

Which companies are most interested in participating in the upcoming tenders in Italy?

We expect large utilities and major operators to account for the lion’s share of the bids. However, large developers will also be important players. Small developers may find themselves excluded due to the high equity investment required by BESS, especially for the long durations (4-8 hours) expected in the upcoming auctions. Importantly, the likelihood of winning a project depends, among other things, on the level of congestion at the transmission node to which that project will be connected. Therefore, the location of projects will also play a key role in the contract awards, which may also benefit smaller players with projects in good locations.