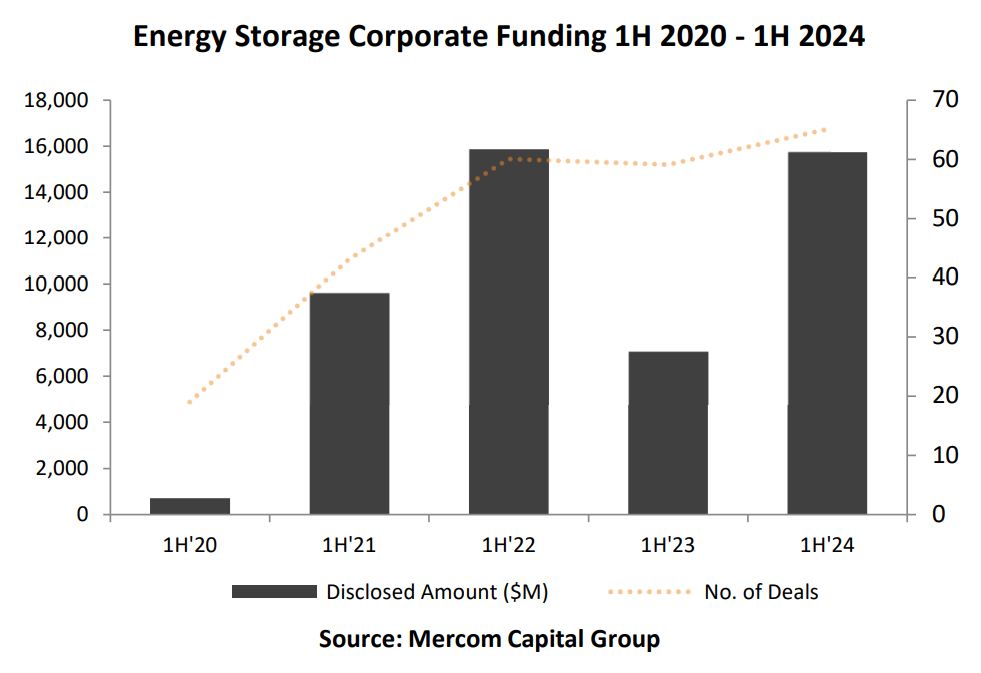

Energy storage corporate funding hits $15.4 billion in H1 2024

Total corporate funding in the energy storage sector reached $15.4 billion in the first half of this year, according to data released by Mercom Capital Group in its latest solar funding and merger and acquisitions (M&A) report. 64 deals contributed to the total.

The figure represents a rise of 117% from the first half of 2023, which was a far more cautious $7.1 billion from 59 recorded deals.

However, the performance of 2024 has yet to beat the overall record from 2022, where a total of 60 deals delivered $15.8 billion in H1 2022. It should be noted that in 2022, the $10.7 billion IPO by LG Energy Solution was a significant one-off that makes comparisons difficult.

The bulk of the funding came from announced debt and public market financing, totalling $13 billion in 16 deals, a 294% increase year-on-year compared to $3.3 billion in 16 deals in 1H 2023. M&A activity in the sector was up year-on-year as well.

At the venture capital (VC) level, 48 deals contributed $2.4 billion in corporate funding in energy storage, down on 2023’s $3.3 billion by 37% in 43 deals.

The majority of VC funding in dollar terms was raised by lithium-ion battery and energy storage companies, but in the top three deals, Sila Nanotechnologies raised $375 million for silicon anodes for lithium-ion batteries in a Series G, EnerVenue raised $308 million for nickel-hydrogen batteries and storage systems, and Natron Energy raised $189 million for sodium-ion batteries.

“The significant increase in corporate funding, despite high interest rates and uncertain macroeconomic conditions, reflects the critical importance of energy storage and its role in the transition to sustainable energy,” said Raj Prabhu, CEO of Mercom Capital Group, further attributing growth to the Investment Tax Credit (ITC), part of the Inflation Reduction Act (IRA). Prabhu noted the pipeline of US storage projects has now grown to around 1 GW.