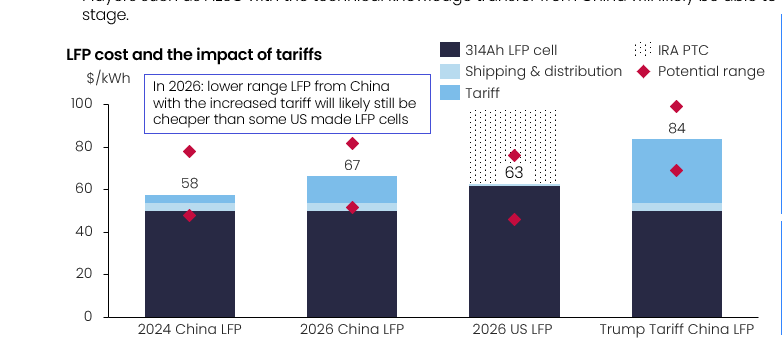

Imported LFP battery cells from China could be cheaper than US-made products even after tariff hikes

Earlier this year, the Biden administration said it would hike tariffs for non-electric vehicle lithium ion batteries from 7.5% to 25% in 2026 in a bid to isolate its supply chain ambitions from China. However, imported LFP battery cells from China could still be price competitive.

According to London-based Rho Motion, lower range lithium iron phosphate (LFP) battery cells from China with the increased tariff will likely still be cheaper than some US-made products.

Earlier this month, the consultancy released the Rho Motion Q3 BESS outlook where it took a close look at the US battery tariffs and their potential impact on the battery energy storage system (BESS) market.

“We currently see prices at around $60/kWh (cell price + shipping + currrent tariff); in 2026 the increase seen will come from the increase in tariff to 25%,” Iola Hughes, head of research at Rho Motion tells pv magazine ESS News.

The tariff hike will take effect in January 2026. However, the upcoming election in the US will significantly influence the LFP price outcome.

Rho Motion calculates that the under the Trump administration the LFP cell price could soar to nearly $100/kWh and average at $84/kWh. This based on proposed significant tariff hikes as part of his presidential campaign, suggesting a “more than 60% tariff on all Chinese imports.”

As seen in the chart above, the consultancy assumes that the price of 314 Ah LFP cell from China (excluding shipping, tariffs) will remain on the same level through to 2026. This is based on expectations for the lithium price to not see a significant rebound in the coming years with the market not looking to go back into deficit until 2027.

The chart highlights the potential for price fluctuations resulting in quite a wide range, which comes from the variations seen in cell price with LFP cell prices in China between $45/kWh and $70/kWh.

“There is much debate in the industry as to the reality behind these prices, how sustainable they are and whether players are selling at a loss to gain market share,” Hughes says.

In two years from now, the LFP production will just be starting in the US backed by the IRA Production Tax Credit (PTC), which provides $35/kWh for cell manufacturing. However, there is potential for significantly higher prices as local players will need time to ramp up production, particularly those without much previous experience in battery manufacturing.

“We do see potential for US made LFP to be cheaper due to the investment tax credit and the impact of the tariff – however this is likely to be hard for some manufacturers, who will be in their early years of ramp, leading to some Chinese cells still being cheaper,” Hughes said.

According to Hughes, players such as AESC with the technical knowledge transfer from China will likely be able to produce at a lower cost from an early stage. However, utimately, lower range LFP from China with the increased tariff will likely still be cheaper than some US made LFP cells in 2026.

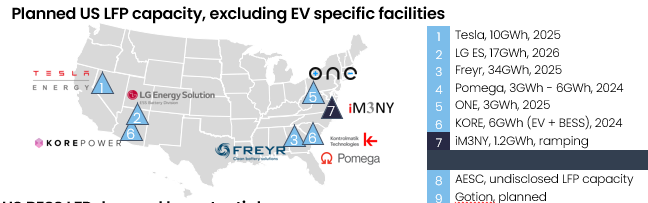

Presently, all LFP battery cell supply to the US comes exclusively from China, but 2026 will look different. Currently, there is a number of domestic facilities dedicated to supplying the storage market planned by established cell manufacturers and battery start-ups, but some have already encoutered the first obstacles.

“Bringing LFP to the US will not be a simple task, and we have already seen delays announced from some players, such as LG Energy Solution in Arizona,” Hughes says.