InfoLink: 2025 energy storage cell shipments jump 95% to 612 GWh as market flips from glut to tightness

InfoLink Consulting has published its 2025 global shipment rankings of energy storage cells, based on its Global Energy Storage Supply Chain Database. It estimates global cell shipments reached 612.39 GWh in 2025, up 94.59% year on year, with a steady quarter-on-quarter rise and Q4 shipments surpassing 200 GWh.

InfoLink describes 2025 as a year of supply–demand reversal. It says the market moved from oversupply to a tight supply–demand balance within six months (from Q2 to Q3) and remains in a cell-shortage phase, after a volatile pricing cycle that ultimately allowed higher costs to be passed downstream. It adds that system integrators increasingly pursued diversified supply structures as prices rose and availability shifted quarter by quarter.

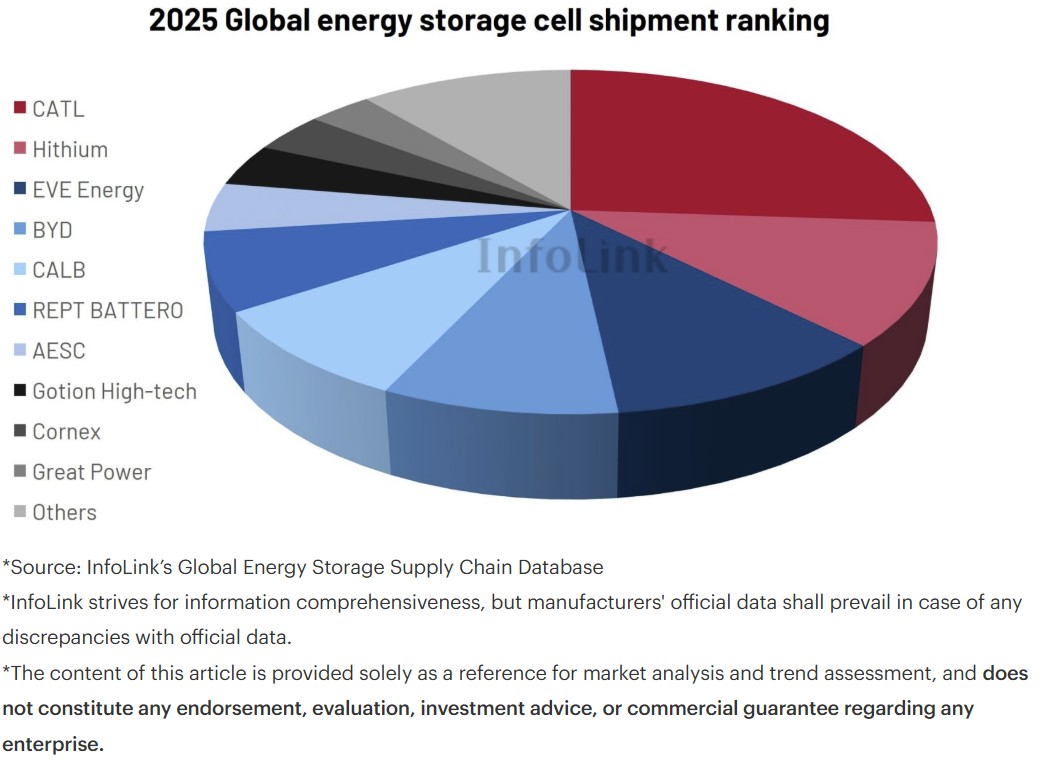

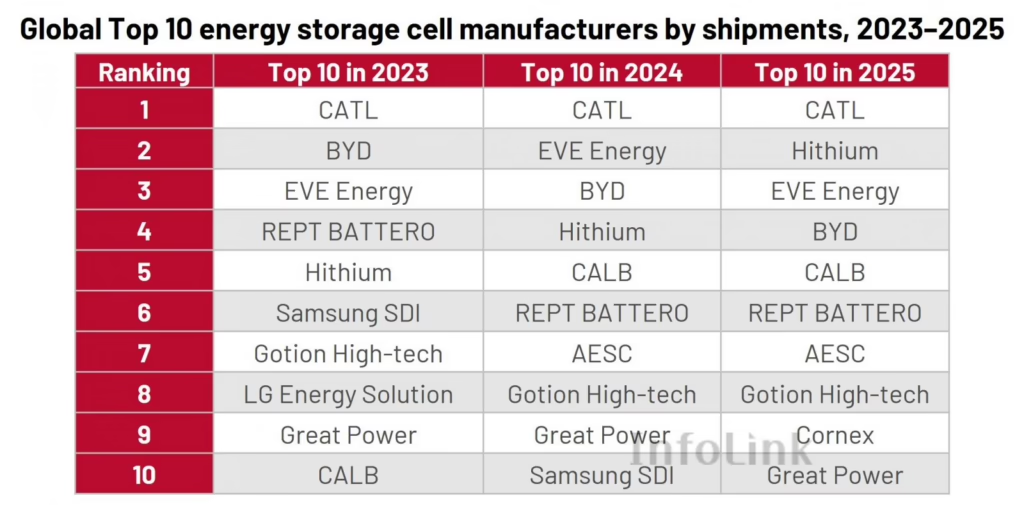

On competition, InfoLink puts industry concentration (CR10) at 88.8%, staying below 90% for two consecutive quarters, which it interprets as stronger shipment momentum among second- and third-tier suppliers. CATL, Hithium, EVE Energy, BYD, CALB, and REPT BATTERO retained the top six positions, with CR6 close to 75%. InfoLink also notes that LG Energy Solution and Samsung SDI continued to decline year on year and, for now, have dropped out of the global top ten.

Segment-wise, InfoLink estimates utility-scale storage cell shipments reached 556.74 GWh in 2025, up 96.73%, led by CATL, Hithium, EVE Energy, CALB, and BYD. It expects 500 Ah+ utility-scale cells to ramp from late Q1 2026 through Q2 2026, with 587 Ah/588 Ah emerging as the main scale-up direction and 500 Ah+ penetration exceeding 15% in 2026.

In small-scale storage, InfoLink estimates 55.65 GWh of shipments in 2025 (+75.54%), with Q4 still growing despite typical off-season softness. EVE Energy, REPT BATTERO, and Great Power held the top three, while the residential segment is expected to accelerate a shift from 100 Ah to 314 Ah formats, with 314 Ah penetration potentially approaching 20% in 2026.

InfoLink estimates non-China market shipments totaled 299.79 GWh in 2025 (about 49% of the global total). It says the non-China share rose to 51.3% in H2 2025, the first time on record that non-China shipments exceeded China. The top five suppliers to non-China markets were CATL, BYD, EVE Energy, CALB, and Hithium, with LGES ninth as the only Korean supplier in the top ten.

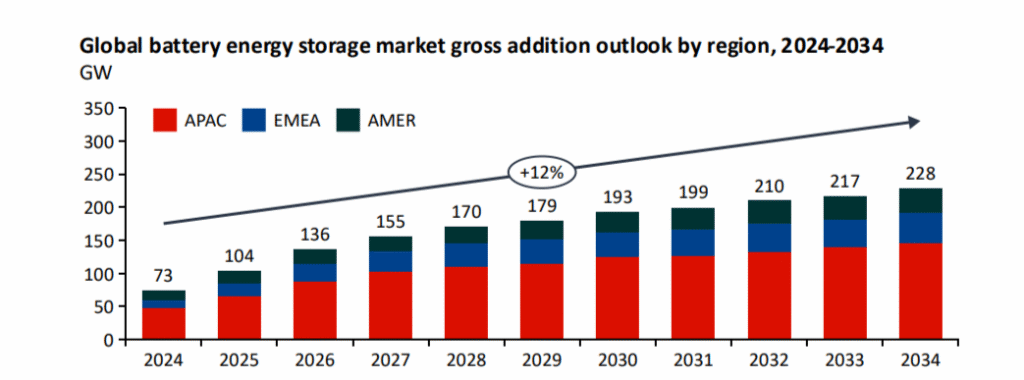

Looking ahead, InfoLink maintains its view of a tight supply–demand balance in H1 2026, easing moderately in H2, and keeps its forecast of 801 GWh global shipments in 2026.