Australian-made vanadium flow battery project could offer storage cost of $166/MWh

The VSUN Energy subsidiary of Perth-headquartered AVL has begun the design phase of a vanadium flow BESS called Project Lumina which is cost competitive and creates a market for AVL’s vanadium oxide production.

In this, second phase of the project, VSUN will develop a construction-ready, detailed design and delivery strategy for modular, commercial, “turnkey,” utility-scale 100 MW VFB BESS with four-hour and eight-hour durations.

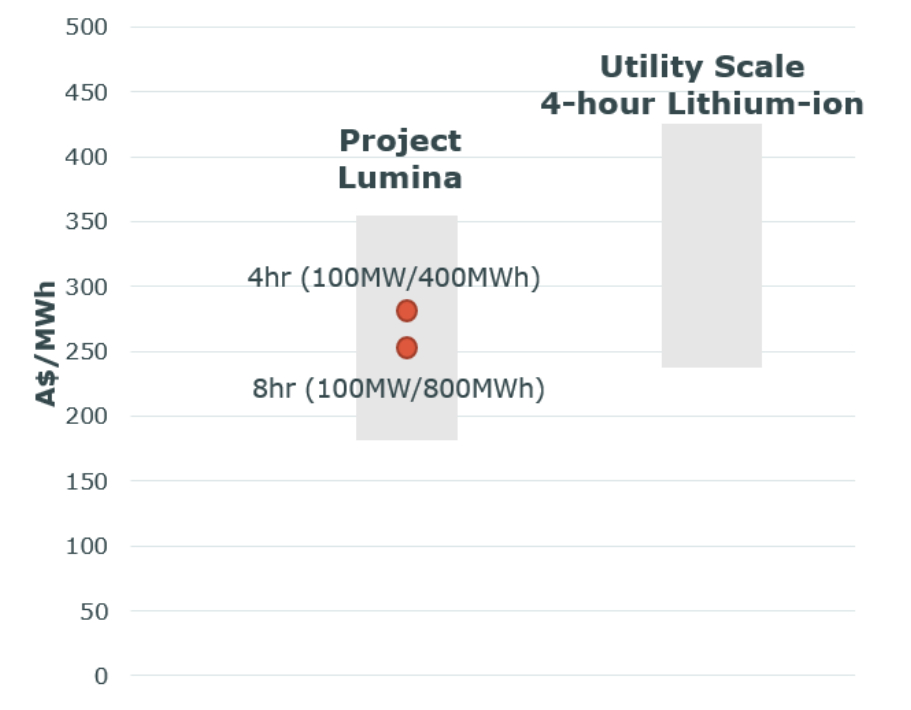

The product will provide a definitive basis for AVL‘s estimates of levelized costs of storage (LCOS), analysed in the project’s first phase, which projected a four-hour, 100 MW VFB BESS would have an LCOS of AUD274 ($181)/MWh and an eight-hour system, AUD251/MWh. The figures had a scoping study level accuracy of plus or minus 30%.

VSUN Energy is proposing to design the VFB BESS with an operating life of 40-plus years. That would be 10 years more than conventional VFB BESS lifetimes.

For AVL, Project Lumina will provide an opportunity for offtake of its planned production of vanadium oxides, from its Australian Vanadium Project, and of Australian-manufactured vanadium electrolyte, all as part of the company’s “pit to battery” strategy.

The vanadium oxides will be used in the midstream production of vanadium electrolyte, supporting VSUN Energy’s downstream VFB BESS installation, operation, and maintenance business.

AVL Chief Executive Officer Graham Arvidson said the move to design phase of the project is a significant step to developing the downstream value of the company’s business.

“The need for long duration energy storage in Australia is rapidly growing and the work the team is undertaking with Project Lumina is a key enabler to create a platform for us to deliver competitive long duration battery energy storage solutions,” Arvidson said. “The scale of the projects VSUN Energy is pursuing aims to provide AVL with the ability to utilise our own manufactured vanadium electrolyte, ultimately unlocking the development pathway and full value of the Australian Vanadium Project.”

Compared to lithium-ion BESS, VFB BESS can conduct multiple full and partial charge and discharge cycles daily without significant degradation over time, allowing for flexible optimization of pricing arbitrage between charge and discharge cycles, as well as increasing the available hours of discharge potential throughout the day.

The Australian Energy Market Operator’s (AEMO) 2024 integrated system plan (ISP) forecasts the requirement for medium duration – four- to 12-hour – storage in the National Electricity Market (NEM) will grow from around 13 GWh, in 2024/25 to an estimated 32 GWh by 2030, and to 81 GWh by 2040 (excluding “deep” storage requirements already allocated to large-scale pumped hydro projects).

The South-West Interconnected System Demand Assessment (SWISDA) forecasts an additional 50 GWh of growth to 2040 for the Wholesale Electricity Market (WEM) in the state of Western Australia, excluding smaller regional networks and microgrids.

Combined, the NEM and WEM are expected to require an average of 7 GWh of newly installed medium storage annually.

The implied average duration for AEMO’s forecast energy storage capacity, excluding pumped hydro, is approximately 11 hours.

From pv magazine Australia.