Volta’s 2024 Battery Report: Falling costs drive battery storage gains

The Volta Foundation has published its annual Battery Report for 2024, spanning more than 500 pages and featuring data and work from 120 battery experts from over 100 institutions.

The latest report opens the hatch on the developments in the industry across investment, manufacturing, supply chain, innovation in chemistry and research, policy, and talent movements in the battery world. A significant proportion is devoted to in-depth details on cell and pack manufacturing, with additional details over previous reports.

The full battery report includes details on both mobile and stationary storage, with much of the focus on EV batteries and the supply chain therein for EVs, as well as stationary.

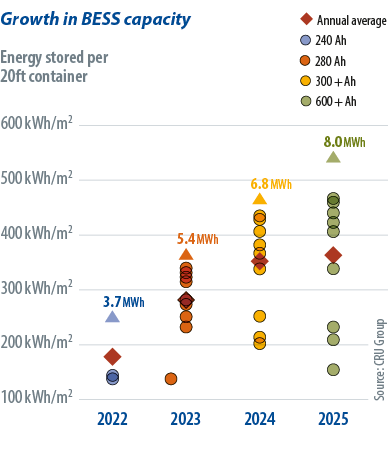

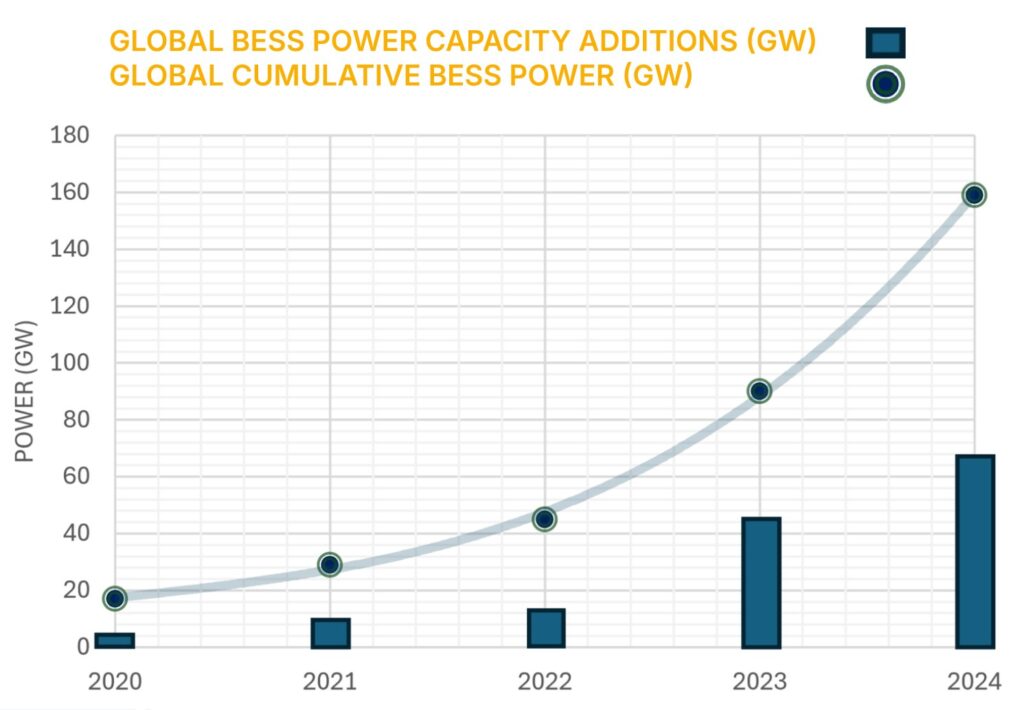

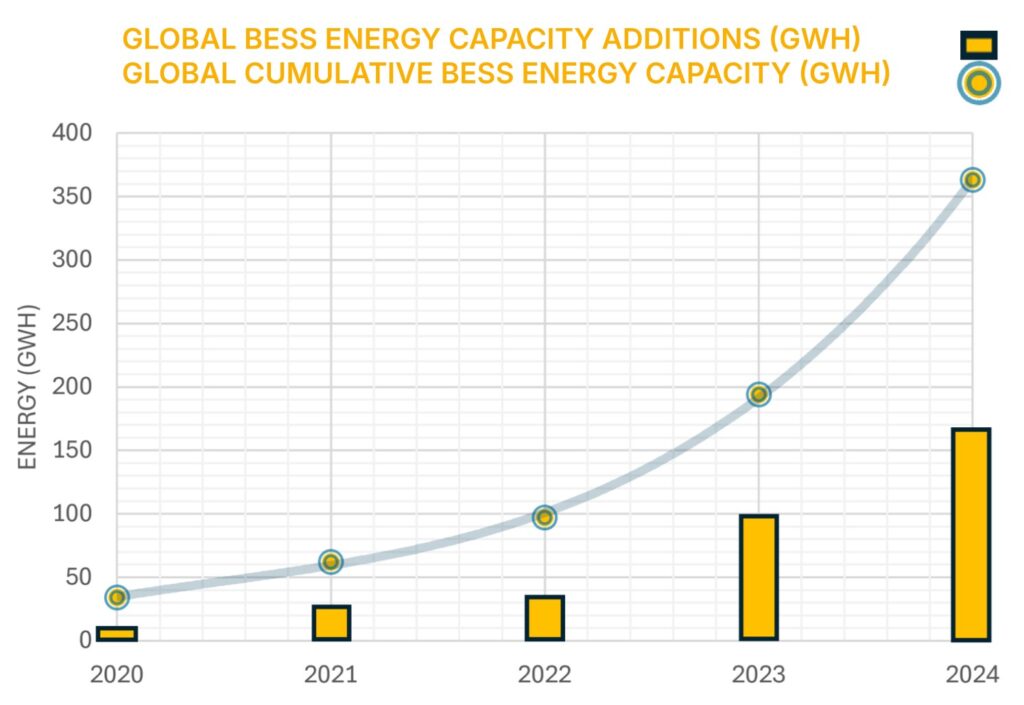

The battery energy storage system (BESS) focus continues to expand in the report, just as it expands in real life. Volta adds data to the global boom in BESS, totalling a 55% year-on-year increase, adding 69 GW / 169 GWh of capacity, with 98% of those installed from lithium-ion batteries.

Considering the hockey-stick style charts showing both power and energy, new BESS installations in 2024 alone accounted for over 45% of the total cumulative global capacity, bringing cumulative BESS to 160 GW / 363 GWh:

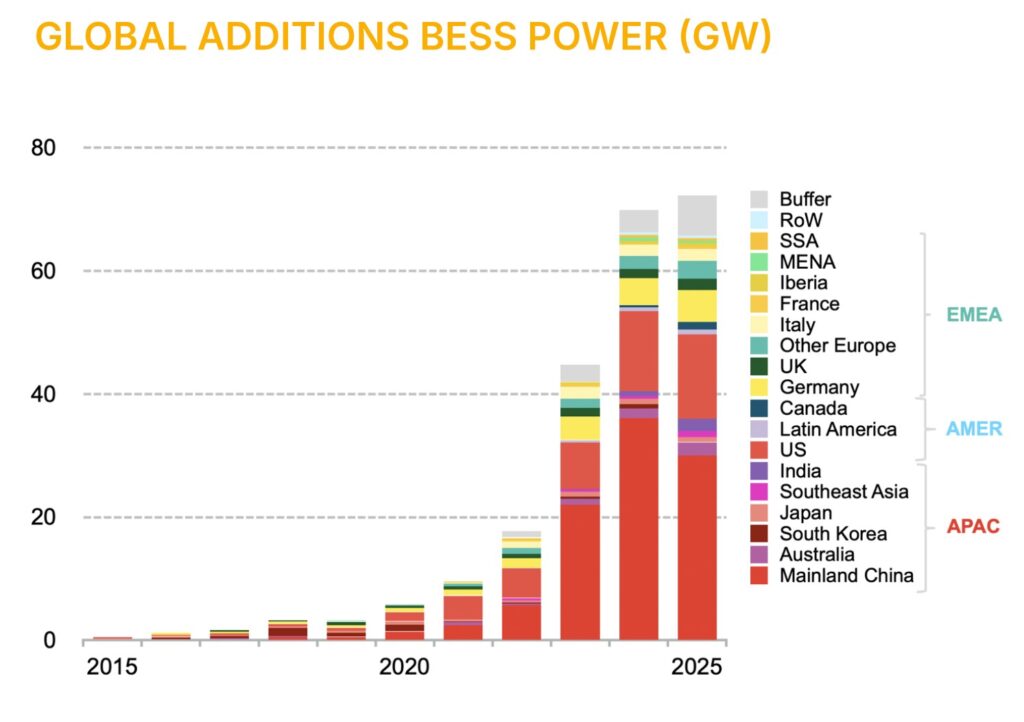

In terms of regional breakdowns, China installed 36 GW, the US 13 GW, Europe 10 GW and Australia 2 GW, with Germany the top country in Europe. The figures show that BESS deployments are growing more than the battery industry on the whole, and lithium-ion will overtake pumped hydro in terms of power output during 2025.

Scale of battery installations are rising too with average project duration lifting. The increase has been 33% from an average of 1.8 hours duration in 2020 to 2.4 in 2024, driven by factors including falling costs, as well the shift from nickel manganese cobalt (NMC) batteries to lithium iron phosphate (LFP), and market forces. That said, the trend was previously a decrease in hours, from 2021 (2.33 hours) to 2023 (just under 2.2 hours), making the uptick in 2024 notable.

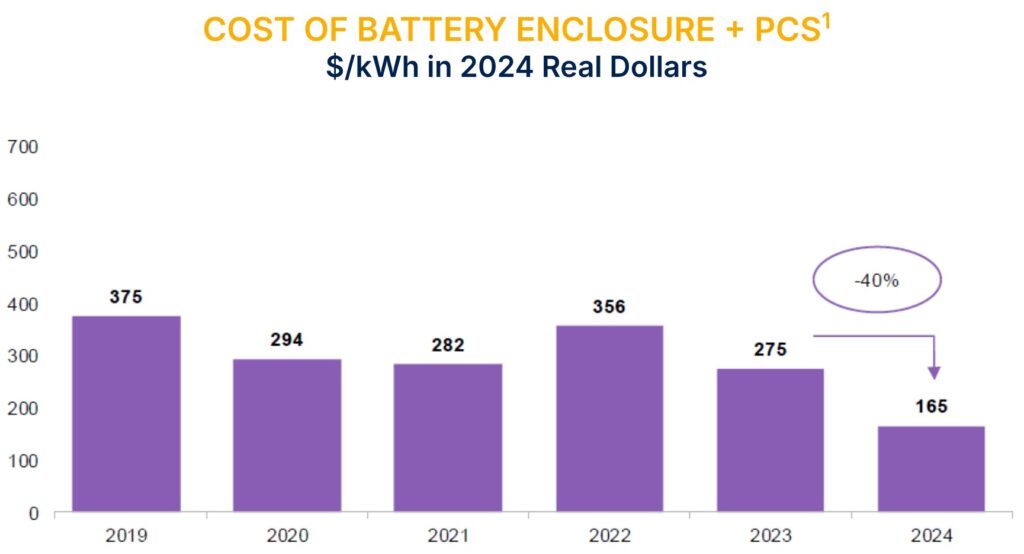

Energy storage costs are not forgotten in the report either. Citing BloombergNEF data, cost per kWh have fallen to $165/kWh in 2023, down 40% from 2023, and half of the $375/kWh with data on the ongoing falls in costs attributed to a less constrained supply chain, dramatically lower lithium prices, and increased competition and scale.

Hints are given that costs are falling further: a December 2024 bid in China for 16 GWh for “battery enclosures + PCS (Power Conversion System),” therefore excluding EPC and grid connection costs, had an average price of $66/kWh, as reported on ESS News. While China’s economics and logistics promote cheaper pricing, the implication is in 2025 of costs taking another step down.

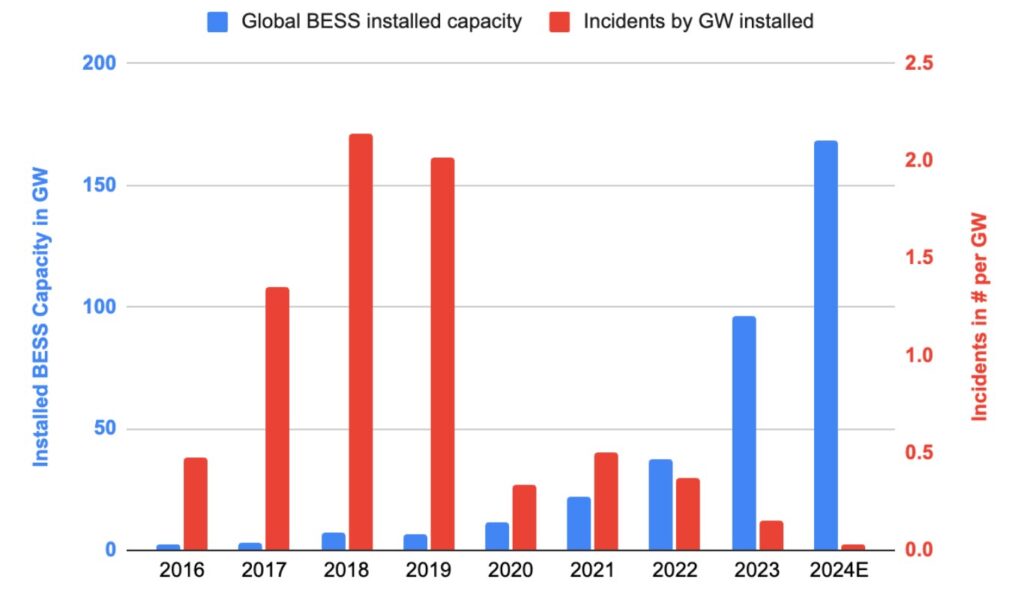

Safety is another focus. 2024 saw a major decline in the rate of BESS safety incidents, with just five significant events occurring in 2024, with three in the US, one in Japan, and one in Singapore. Compared to the exponential growth in GW installed, the rate of incident is down to around 0.03, the lowest figure since 2016:

A study by EPRI, referenced by the report, indicates balance-of-system components and controls were the leading causes of failure, with the actual battery cell having a relatively small number of failures attributed to it:

The ESS News team will continue to examine the report over the coming days for information on use cases, more on safety, and investment.