CATL reports profit growth despite revenue decline, announces $2.8bn dividend plan

Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest lithium battery manufacturer, reported a 9.7% year-on-year decline in revenue to CNY 362.01bn ($50.4bn) in 2024, while net profit attributable to shareholders rose 15.01% to CNY 50.75bn ($7.1bn). The company plans to distribute a total cash dividend of CNY 45.53 per 10 shares, reflecting a strong commitment to shareholder returns.

CATL attributed the revenue decline to price adjustments following a drop in lithium carbonate and other raw material costs, despite continued growth in battery sales. However, the rise in net profit was supported by ongoing improvements in research and development, product capabilities, and operational efficiency.

The company remains a dominant force in the global battery market, with its lithium-ion battery sales reaching 475 GWh in 2024, a 21.79% increase from the previous year. This includes 381 GWh in electric vehicle (EV) battery sales (+18.85%) and 93 GWh in energy storage battery sales (+34.32%).

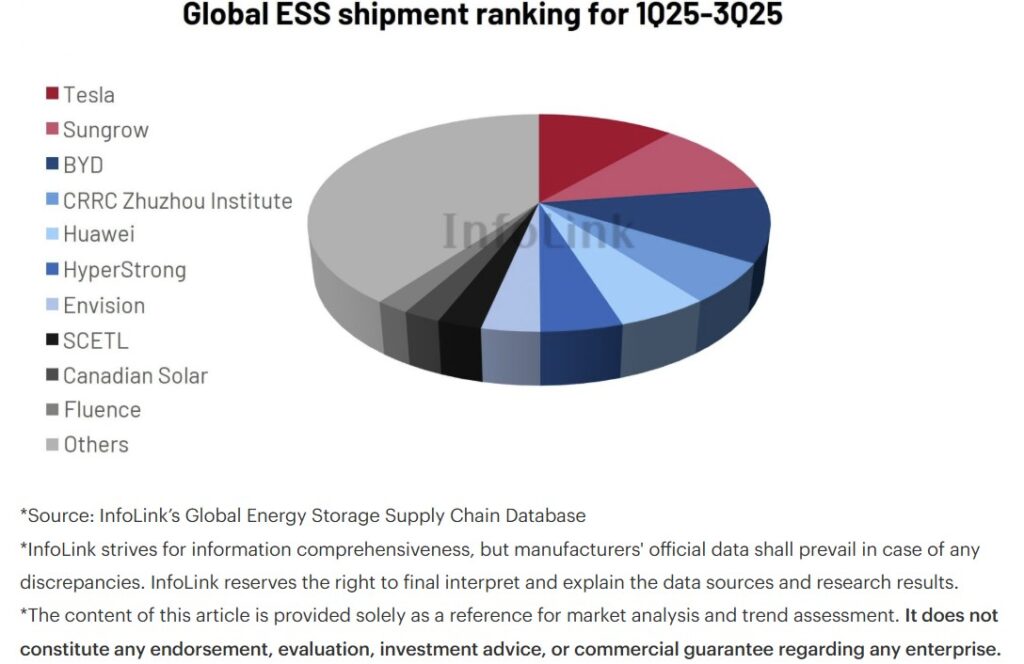

According to SNE Research, CATL has maintained its position as the world’s leading EV battery supplier for eight consecutive years (2017-2024), holding a 37.9% market share in 2024—20.7 percentage points ahead of its nearest competitor. In the energy storage sector, it has led global shipments for four years, with a 36.5% market share, surpassing the second-largest player by 23.3 percentage points.

While EV battery systems remain CATL’s core business, energy storage solutions are playing an increasingly significant role. The company’s financial report highlights a shift in revenue composition: energy storage battery revenue accounted for 15.83% of total sales in 2024, up from 14.94% in 2023, while EV battery revenue declined from 71.15% to 69.9%.

CATL sees substantial growth opportunities in the data center sector, driven by the rapid expansion of AI computing power. Next-generation data centers built around GPUs require higher energy density and uninterrupted power supply, creating new demand for advanced energy storage solutions.

The company has proposed a dividend payout of 50% of its 2024 net profit (CNY 25.37bn), including an annual dividend (20%) and a special dividend (30%). After an advance special dividend payment of CNY 5.4bn in January 2025, the remaining payout will total CNY 20bn ($2.8bn).

Furthering its global expansion, CATL plans to raise at least $5bn through a Hong Kong listing, with proceeds earmarked for overseas capacity expansion, international market development, and working capital support.

On the same day as its annual report release, CATL announced plans to issue up to $1.5bn in offshore bonds through its existing or newly established overseas subsidiaries. The proceeds will support projects including its battery plants in Germany, Hungary, and Spain, as well as its integrated supply chain in Indonesia.

CATL is also accelerating its domestic production capacity. The company recently committed CNY 8bn ($1.1bn) to build the world’s first high-proportion green power zero-carbon industrial park in Dongying, Shandong. The facility’s first phase will include 40 GWh of battery cell production capacity, with future expansions covering key lithium battery materials such as green DMC, green electrolytes, silicon-based anodes, and lithium iron phosphate cathodes.

*The title of this article was amended on March 20 to reflect the fact that CATL’s dividend plan amounts to CNY 20 bn ($2.8 bn) rather than $20 bn as previously reported.