German batteries stabilizing solar energy prices at expense of own profitability

Negative electricity price periods are becoming more frequent across Europe, driven during peak solar generation hours, and batteries offer the grid flexibility required to even out loads.

With batteries booming as project developers scramble to install them, THEMA has investigated what this means for solar and battery business cases.

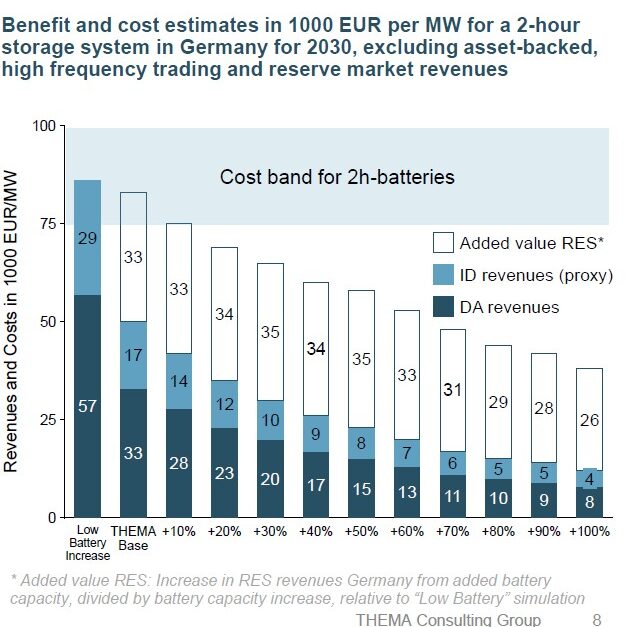

The analysts said battery “investment costs are still considerable” but pointed to falling costs and increased electricity price volatility. THEMA estimates current battery costs at €75,000 ($88,000) to €120,000 per megawatt, per year for systems with two hours of storage capacity, depending on cost assumptions, service life, and weighted average cost of capital.

“Assuming one cycle per day and no losses, the average spread that must be achieved per day is €100 per megawatt-hour or higher,” wrote THEMA, referring to a daily two-hour charging and two-hour discharging cycle. The report added, however, “In reality, the spread must be even higher to cover potential operating costs, degradation costs, or losses.”

While those figures relate to trading on the day-ahead market, THEMA pointed out revenue can also be earned on the intraday, balancing power, and grid services markets, although that could affect the capacity available for day-ahead market returns.

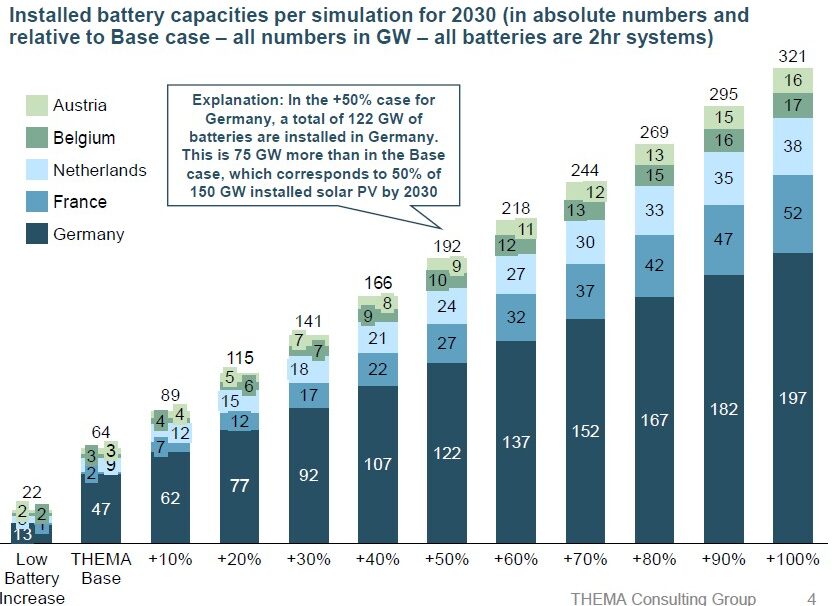

The analyst modeled the impact of batteries based on various 2030 deployment scenarios. A modest model envisaged around 13 GW of battery capacity in Germany, including residential systems; and the THEMA “base case” scenario predicts 47 GW of mostly two-hour storage capacity. The analysts also modeled scenarios linked to solar deployment, ranging from battery capacity additions equal to 10% of anticipated new solar up to fully matching new solar rollout. The latter figure would see the nation have 150 GW of battery capacity to match its 150 GW solar target for 2030 but the THEMA analysts said that was unlikely given battery project lead times and grid connection waiting times.

While more batteries will even out electricity supply to better match demand – and stabilize solar electricity prices – they will also reduce arbitrage revenue for the storage systems. “It is likely that revenue streams from other markets, such as continuous intraday trading and intraday auctions, will also decline,” the analysts wrote. “As with many other technologies, batteries also experience a cannibalization effect: The more batteries come onto the market, the worse their business becomes.”

Batteries would have a less dramatic effect on wind power, according to THEMA, and could even reduce wind electricity prices during moderate generation periods in winter.

“Batteries help reduce market-based curtailment of renewable energies,” wrote the analysts. “In the 100% [battery to solar capacity] scenario, the renewable output for photovoltaic and wind power systems increases by around 13 TWh due to the lower curtailment compared to the baseline scenario.”

Even that 100% solar-to-battery deployment ratio would leave 850 hours per year in which electricity prices would be at, or below 0, according to THEMA. That compares with 1,500 such hours in THEMA’s base case, and 1,625 hours in the event of no new battery capacity being added between now and 2030. “Even with high battery capacities, a certain amount of [price] volatility remains,” stated the analysts. “But this remaining volatility may not be sufficient to refinance the battery investment.”

“We observe that increasing battery volumes are leading to a sharp increase in the market value of photovoltaics,” the analysis stated. “However, as volatility decreases, with more batteries, revenues for battery storage systems are also coming under pressure.”

The more batteries are deployed, the more their business case will deteriorate, according to the analysis, even when other energy markets are considered. “As battery volumes increase, the attractiveness of these other markets would also come under pressure,” stated THEMA. “After all, day-ahead and intraday volatility are strongly linked and the balancing power markets are rather small.”

In the no-new-batteries scenario, THEMA calculated annual revenue of €86,000/MW from day-ahead and intraday trading for two-hour batteries (see chart above). That number falls to €50,000/MW in the 47 GW of batteries base case scenario, and to €12,000/MW in the 100% solar-to-batteries model.

THEMA concluded “Higher revenues from renewable energy should not be seen as a justification for subsidizing battery storage. While batteries can enable higher returns for renewable energy, this alone does not justify market intervention. Granting subsidies on this basis would amount to a technology-specific support system with significant impacts – not only on photovoltaics but also on gas-fired power plants and other important flexibility investment.”

From pv magazine Deutschland.