‘After the blackout, we saw a 70% increase in demand for batteries and hybrid kits’

Clean energy equipment wholesaler Solarbox was founded in 2017 and has 12 technical, sales, logistics, and customer service staff. pv magazine Spain interviewed CEO Javier Rodríguez Lizcano.

What is Solarbox’s business model?

Javier Rodríguez Lizcano: We work as a wholesaler for strategic distributors and professional installers, offering everything from solar modules to batteries, inverters, and complete solutions.

Solarbox is present in Spain with offices and logistics centers in Toledo. It has a warehouse with a total area of 5,000 m². Internationally, it has begun its expansion and we have an office in Colombia under the Solarbox Colombia brand.

We carry out national distribution from our strategically located logistics warehouses in the center of the country, with rapid deliveries and personalized technical support.

Which partners and manufacturers does Solarbox work with?

We work with top-tier manufacturers such as Steca, FOX ESS, and Azzurro, on inverters, solar batteries, and panels with Tier 1 brands, among others. This collaboration guarantees high-quality products, reliability, and technical support.

What is the best-selling photovoltaic technology and what is your forecast for 2026?

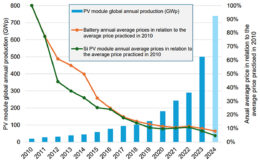

Currently, high-voltage batteries, due to their high performance and price drops in recent years, are … popular. Of course panels, where the best-selling technology is PERC [passivated emitter rear contact] monocrystalline, although significant growth is being observed in n-type modules (TOPCon [tunnel oxide passivated contact] and HJT [heterojunction]). By 2026, we expect more than 60% of sales to be n-type modules due to their greater efficiency and durability.

How are battery sales evolving? And what about charging stations?

Regarding batteries, year-on-year growth is expected to be 10% in 2024, and 50% by 2025. Following the blackout, demand for hybrid systems has skyrocketed. Regarding charging stations, we are seeing a sustained 5% annual increase driven by electric mobility, which has stagnated somewhat in 2025.

What is the best-selling photovoltaic module model? And what about inverters?

The best-selling module in 2025 is the module found from 550 W to 600 W [in] Tier 1 [supply], in Spain. In Europe we are still seeing how models below 500 W are more common.

As for inverters, I think we can talk about any FOX-ESS mono-hybrid, from 5 kW to 10 kW. The brand’s hard work has made it a premium brand and the market is increasingly demanding it.

What is the percentage of battery sales to modules in 2025 – versus 2024 – in Spain?

In 2024, batteries represented 10% of sales volume compared to modules. By 2025, that percentage is expected to rise to between 30% and 40% thanks to growing interest in energy self-sufficiency and storage.

Has there been a rebound in sales since the blackout?

Yes, after the blackout, there was a 70% increase in demand for battery kits and hybrid systems, especially among residential and small business customers.

Could you tell us what the company’s current inventory is? What was it like during the same period in 2024?

Currently, the available stock consists of all high-turnover elements: Single-phase inverters ranging from 3 kW to 10 kW; three-phase inverters for small industries, up to 50 kW; and inverters ranging from 100 kW to 250 kW for EPC [engineering, procurement, and construction]; always accompanied by 50 kW and 10 kW batteries. During the same period in 2024, the stock was lower, reflecting a more proactive demand forecasting strategy for 2025.

What marketing strategy is best suited to adapt to the current market situation?

A strategy focused on digitalization, technical training for installers, content marketing on social media, and alliances with strategic suppliers is key. Furthermore, we must offer trust, proximity, and reliability to our distributors.

What state policies should be implemented to attract manufacturers and encourage the development of photovoltaics in Spain?

We believe these could be some of the important points to discuss to help develop photovoltaics in Spain:

- Tax incentives for manufacturers.

- Streamlining permits and procedures.

- Subsidies for storage facilities.

- Development of sustainable industrial hubs.

- Technical training in vocational training and universities.

What are the main challenges for distribution and manufacturing right now?

Within distribution, there are major challenges such as the entry of new brands that bypass the distribution channel and the instability and trust of these brands that no longer exist two years later and cannot meet … guarantees.

This can be fixed by remedying the following problems:

- Regulatory instability.

- Fluctuations in transportation costs.

- Temporary shortages of chips and electronic components.

- A price war.

What developments and forecasts do you foresee for 2025 and 2026?

We expect average annual growth of 20% in the self-consumption market, driven by the increased use of batteries, technological improvements, and environmental awareness. This leads us to anticipate a significant increase in storage installations and smart solutions.

Finally, could you tell us if you have any special projects for this year?

Yes, we launched an initiative to develop our office in Colombia in 2024, which was presented at Exposolar.

From pv magazine España.