Enervis Battery Storage Index: Revenues remain high in June 2025

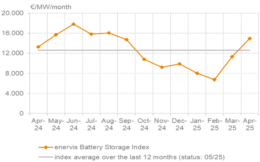

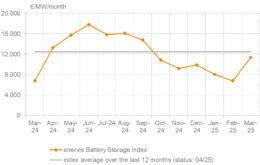

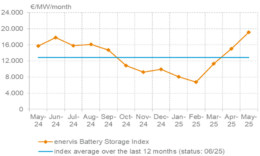

Since the first quarter of 2025, at Enervis, we have been publishing a monthly Battery Storage Index based on historical market data. The first publication of the index was presented in an initial article in March 2025. The index illustrates revenue opportunities for battery storage systems by accounting for participation in both the intraday and balancing power markets. It provides an overview of achievable revenues for each of the past 13 months.

New revenue figures for June 2025

In June 2025, achievable revenues declined slightly but remained at a high and stable level, amounting to around €17,800 per megawatt. This represents a 7% decrease compared to May, which had marked a historic peak, but remains in line with the level of June 2024. In June 2025, photovoltaic (PV) feed-in reached a new all-time high. The ongoing expansion of installed PV capacity is increasingly impacting the market, leading to a growing number of hours with negative prices and correspondingly high price spreads in both the day-ahead and intraday markets. These market conditions continued to support arbitrage revenues for battery storage systems. However, this positive effect was partially offset by a decline in revenues from ancillary services. As a result, total revenues in June were slightly below the previous month’s level but remained high in historical comparison.

General trends

The monthly achievable revenues have fluctuated significantly over the past 13 months. They ranged from a low of €6,770 per megawatt per month in February 2025 to a peak of €19,100 per megawatt per month, reached in May 2025. Revenues tend to be higher during the summer months, largely due to strong PV generation combined with relatively low overall electricity demand. In addition, conventional generation capacity is typically lower during summer, partly because of scheduled maintenance and, in the case of gas-fired power plants, potentially reduced efficiency under high ambient temperatures. Wind generation availability also tends to decline in summer compared to autumn and winter. As a result, short-term fluctuations or forecast errors in PV feed-in lead to increased market volatility during these months reflected in more dynamic activity on the intraday market. On average, battery storage systems generated almost €12,900 per megawatt per month in the last twelve months, amounting to approximately €155,000 per megawatt annually.

Current Expected Revenues 2025

In line with the historical methodology, the Enervis Battery Storage Index also provides a forward-looking view of revenue expectations for the current year. Based on Enervis’ latest electricity price forecasts for the intraday and balancing power markets, the operation of a typical standalone battery storage system in 2025 has been modelled.

For the achievable revenues in the full year 2025, the underlying power price scenario has been updated to the Q3/2025 scenario. Compared to the previous assumption (Q2/2025), this results in an increase of approximately €3,800 per megawatt per year, bringing the projected revenues to €151,600 per megawatt per year. This increase is mainly due to a rise in the average daily day-ahead spreads in the model, about €5 per megawatt-hour higher than in the previous scenario, as well as a slight increase in ancillary power prices.

The projected revenues for 2025, at €151,600 per megawatt per year, are slightly below the average of achievable revenues over the past twelve months but remain within the same overall range, as illustrated in the BESS-Index. The underlying storage parameters have been kept unchanged.

Methodological explanation: The Enervis Battery Storage Index shows the monthly net revenues that can be achieved historically and in the future in Germany for a 1 megawatt capacity and 2 megawatt hours storage volume (2 hours) battery storage system. The storage system was modeled with a use restriction of 1.5 cycles per day, a maximal depth of discharge of 90%, a technical availability of 97% and a round-trip efficiency of 87%. The index takes into account participation in the following markets: Intraday, Frequency Containment Reserve (FCR) and automatic Frequency Restoration Reserve (aFRR). Imperfect foresight and no revenues from aFRR energy are modeled. The respective prices of the markets for the historical analysis are taken from publications of the transmission system operators and EPEX-Spot. The future outlook is based on the same modeling and parameters and prices from the current Enervis power price scenario Current Efforts Q3/2025.

Further information:

If you are interested in a more detailed analysis and the full report, you can request it here.

About the authors:

Mirko Schlossarczyk – Managing Director of enervis energy advisors is an experienced energy market expert. His consulting focus is on electricity price forecasts, electricity market scenarios and the asset valuation of BESS.

Jonas Anthonioz – Consultant at the energy economics consultancy enervis energy advisors, where he is responsible for battery storage-related topics. In addition to his usual tasks in revenue assessment and profitability analysis of battery storage projects, he developed the enervis BESS Index and the associated BESS Index Report.