Profitability in quieter markets: what July revealed about battery strategy

Battery storage revenues in Germany have been on a remarkable run in recent months. April, May, and June each delivered strong income opportunities across both spot and ancillary markets, with systems optimized for multi-market participation generating substantial rewards. May and June in particular, set new records for standalone battery revenues this year – a clear signal of just how lucrative flexibility can be when volatility runs high. But no rally lasts forever.

In July, markets took a breather. Spot price volatility softened, while FCR [frequency containment reserve] and aFRR [automatic frequency restoration reserve] capacity prices returned to levels last seen in February and March. Consistent summer temperatures and high, but predictable, solar output dampened demand shocks and reduced short-term imbalances. The result: less volatility across all relevant markets – and with it, narrower trading margins.

Yet this shift doesn’t lessen the need for intelligent, multi-market strategies. On the contrary, in a flatter landscape, only coordinated strategies can consistently extract value.

Price signal reset

Where May and June were marked by pronounced ancillary price spikes and spot market turbulence, July saw a rebalancing across markets. Spot spreads narrowed and ancillary services fell back to levels last seen in early spring.

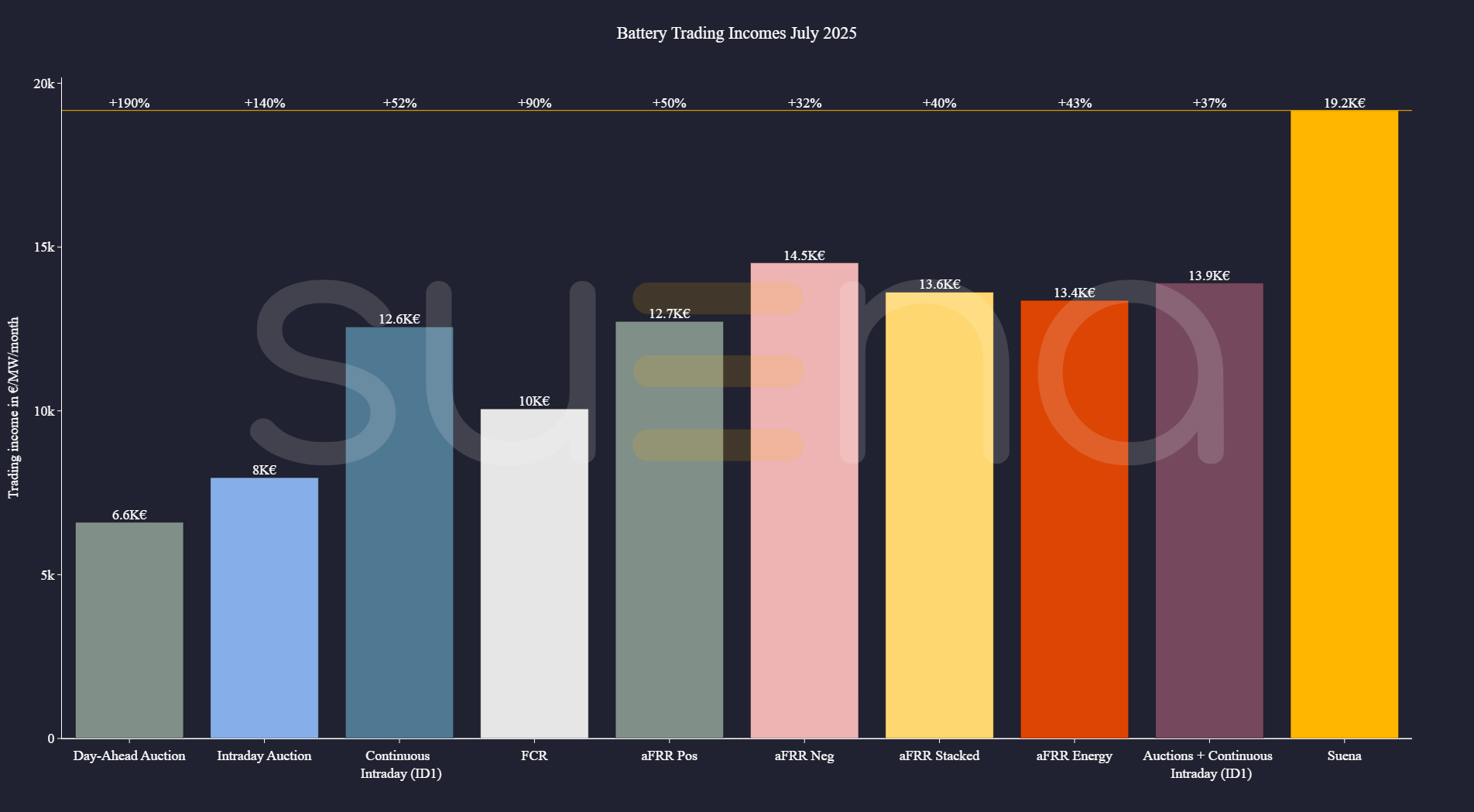

Across all benchmarks, simulated maximum revenues on single spot markets ranged between €6,600 ($7,700) and €12,600 per megawatt, with the stacked spot benchmark reaching €13,900. Ancillary services delivered slightly higher upside: €10,000/MW on FCR and up to €14,500/MW on stacked aFRR capacity. Even the aFRR energy benchmark PICASSO [Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation] returned to a stable mid-range, landing at €13,400/MW.

Why markets slowed

This cooling of revenue potential in July reflects a broader seasonal and operational trend. After months of fluctuating renewables output and grid tightness, July benefited from high but stable solar generation, lower redispatch activity, and more predictable demand. In contrast to May’s early summer volatility, and late June’s heatwave-induced spikes, July (with the exception of July 1) presented fewer imbalance signals and narrower spreads – especially in the continuous intraday market. Additionally, the number of hours with negative intraday prices – which typically provide valuable charge opportunities for batteries – dropped dramatically.

Ancillary services followed suit. FCR capacity prices softened compared to June’s peak, and aFRR capacity, while still solid, no longer reached the extreme highs seen in May. A key driver was the wholesale backdrop: With fewer intraday spreads and negative-price hours, the opportunity cost of committing batteries to reserve provision declined. In calmer markets, arbitrage is less lucrative, competition in the capacity market intensifies, and prices naturally ease. At the same time, PICASSO activations plateaued, with July largely devoid of the sharp up- and down-regulation events of the prior months. This indicated fewer system-level stress situations requiring emergency reserves.

In such conditions, revenue stacking becomes less about chasing peaks and more about maximizing coordination across moderate opportunities. For BESS operators, July was a reminder that market slowdowns do not necessarily come with lower absolute price levels – but with the absence of volatility that drives value creation.

Slow-month strategy

For our July benchmark, we once again modelled a 10 MW/20 MWh standalone BESS, using Suena’s Energy Trading Autopilot. The system was operated with 90% round-trip efficiency, no perfect foresight, and full compliance with market rules across all relevant products: spot markets (day-ahead, intraday auction, and continuous intraday), FCR, and aFRR (including PICASSO energy activation). Average cycling stood at 2.12 per day.

Against this backdrop of slower price movement, our multi-market strategy generated €19,200/MW in trading revenues – down from May and June’s peaks of over €31,000 but still significantly outperforming all static benchmarks.

Compared to the stacked spot strategy, the Autopilot delivered 37% higher revenue. Against FCR alone, the outperformance climbed to 90% and even against aFRR capacity benchmarks, gains ranged between 32% and 50%. Single spot market strategies lagged further behind, underperforming by up to 190%.

In other words: even in flatter market environments, a flexible, data-driven strategy continues to deliver a decisive edge.

Strategy still matters

Simulations, of course, are only part of the story. No benchmark, however detailed, can fully account for the complexity of real-world operations: asset-specific limitations, redispatch impacts, maintenance schedules, or regulatory shifts. Market signals may look favorable in hindsight but executing on them reliably requires systems that understand the rules and technical constraints in real time.

This is precisely where real-time optimization, grounded in both market intelligence and asset-specific operating logic, becomes essential. In months like July, successful strategies become less about chasing high returns in a single market and more about continuously reallocating capacity across multiple markets – and adapting those allocations as conditions shift.

Our Energy Trading Autopilot did exactly this: reallocating FCR capacity when bids were missed, shifting charge profiles in response to softening aFRR prices, and dynamically adapting to reduced spread opportunities in the intraday market. The result wasn’t record-breaking returns but resilient, risk-adjusted performance in a difficult market.

Looking ahead

In contrast to recent months, July illustrates a kind of market regime that is defined not by volatility, but by its absence. As price spikes give way to quieter weeks, and as market dynamics shift from disruption to rebalancing, battery strategies must adapt to both extremes.

However, periods of relative calm are unlikely to define the remainder of the year. Renewables fluctuation, seasonal demand swings, and systemic stress events – from “Hitzeflauten” to “Dunkelflauten” – remain structural features of the energy system. Add to this a backdrop of changing technical conditions and regulatory reform, and the likelihood of renewed price dislocation is high. In both high- or low-volatility cases batteries must do more than react – they must anticipate, adapt, and reposition. This demands more than market intuition. It requires a strategy that sees beyond any single product or price signal – one that coordinates across markets, timeframes, and constraints.

About the author:

Dr Lennard Wilkening is co-founder & CEO of suena energy, a green energy marketer for battery storage and renewables. suena offers marketing solutions that enable profit-maximizing multi-market trading and implement them through powerful trading algorithms. Lennard holds a PhD in grid-oriented use of battery storage systems from the Technical University of Hamburg and has more than nine years of experience in battery storage optimization and energy trading.