SolaX Power: Batteries to drive Brazil’s energy transition

Energy storage is beginning to consolidate itself as a central piece of Brazil’s energy transition and, in a mature solar market, batteries are emerging as a natural complement to solar, creating business opportunities and strengthening energy security. That is the assessment of SolaX Power Brazil CEO Gilberto Camargos, who has given an exclusive interview to pv magazine Brasil.

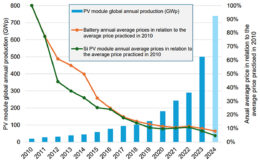

The executive said developments in the battery market are similar to what the country experienced with the expansion of solar energy but with the advantage of a structured sector with access to finance, monitoring, and valid business models. “Batteries aren’t here to kill solar but to complement it,” said Camargos. “They’re solar 2.0, enabling generation, storage, and reducing grid dependence.”

SolaX recently presented three storage system models. Two are physical units: An alternating current-coupled battery energy storage system which is in high demand, and a hybrid model with an inverter integrated into the battery bank which can be expanded up to 400 kWh of capacity. The third product, called ORI, is aimed at the utility-scale market and starts at 2.5 MW/5 MWh. A physical version is expected in the country next year.

The company also invested in solutions for retail. The 1,875 Wp Fast Track micro system is described as ideal for Brazil and a pioneer compared to the 2.5 kWp model that is offered by competitors. SolaX also launched a 37.5 kW, three-phase, 220 V hybrid inverter accompanied by a 7.5 kW hybrid split-phase inverter. The Balcony product, designed for apartments and inspired by the up-to-800 W European systems which do not require certification, has also garnered attention. In Brazil, the equipment will operate in off-grid mode, directly powering residential loads.

For Camargos, the Balcony is a promising solution in metropolitan markets such as São Paulo, where blackouts are frequent during periods of intense heat. “Although there are aesthetic concerns, the storage benefits should outweigh the impact,” said the CEO.

SolaX’s strategy reflects an understanding of the industry that sees storage as a natural path for evolution. Camargos predicted the industry trajectory will follow the same logic as solar energy: Starting with residential, moving to small- and medium-sized businesses, and then conquering large corporations. The difference is that batteries are already entering a mature market and no longer need to prove their viability. In Camargos’ view, the future will be hybrid and grid-connected, but with the ability to store energy and turn the grid into a support system rather than the main protagonist.

Obstacles remain, however. An increase in the Selic rate makes finance more expensive and industrial policy measures such as the ex-tariff are seen as causing unhelpful distortions in the market. Camargos added, lack of regulation for the nighttime injection of stored energy and delayed rules for large-scale systems are limiting the development of new business models. “The government is behind schedule in this process and the sector cannot wait for auctions or regulations to move forward,” said the CEO.

Nevertheless, storage market opportunities are enormous. Brazil suffers from deficient electrical infrastructure, creating room for backup and energy management solutions. In some industrial projects, returns can be almost immediate: In cases of factory shutdown, payback can be achieved via up to 60 hours of avoided downtime.

The string inverter and microinverter market is experiencing a price war that pressures manufacturers to find cost savings, potentially at the expense of quality. SolaX wants to differentiate itself by focusing on hybrid inverters which offer better margins and lower safety risks and the company offers a 10-year product warranty, regardless of distributor, unlike many of its competitors.

The business is betting on batteries, with Camargos adding, “The demand is already there and those who understand this will come out ahead. Batteries won’t wait for regulation, or an auction, to become established. The movement has already begun.”

From pv magazine Brasil.