Between the peaks: Battery strategy in a moderate August

Battery revenues don’t move in straight lines. Some months are defined by extremes. Others, by the absence of them. August fell somewhere in between. After July’s drastic downturn, markets didn’t rally, but they also didn’t stagnate. Income opportunities increased – at least slightly – reflecting a modest rebound in solar volatility, stronger ancillary signals, and broader arbitrage windows across the spot market. For battery storage, this wasn’t a return to the early summer highs. But it confirmed what the calm July already hinted at: flexibility pays even in less volatile markets – if deployed intelligently.

August in Numbers

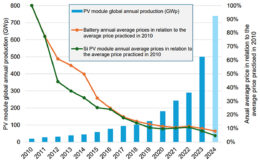

In May and June, battery profitability was driven by pronounced market events: surging aFRR prices, extreme negative hours, imbalance volatility, and heatwave-induced demand shocks. In July, those signals disappeared almost entirely – and with them, much of the arbitrage upside. August didn’t bring those extremes back, but it did see a moderate uptick in opportunities.

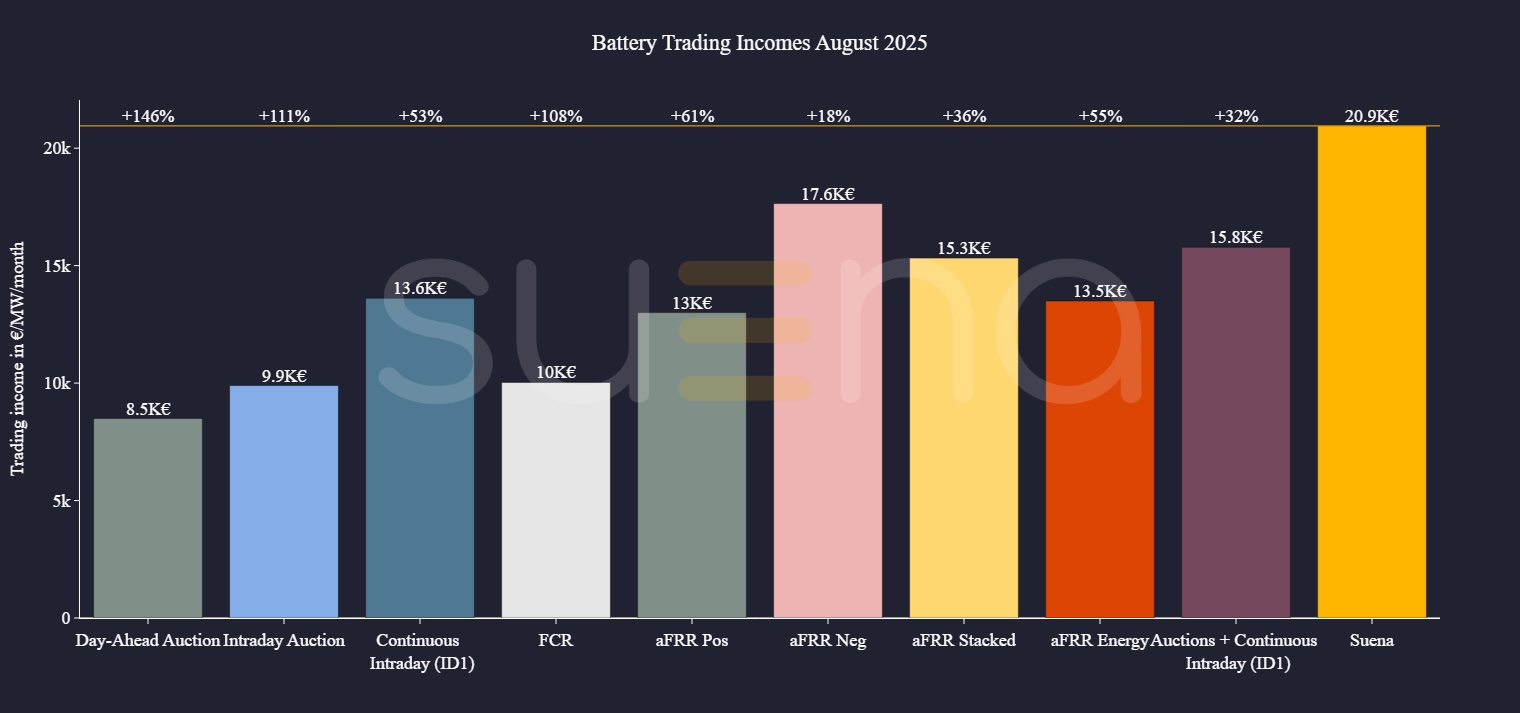

Our simulation benchmarks reflect this. Linear optimization climbed to €15.8k per MW when trading across all three spot market layers. Single spot markets returned between €8.5k and €13.6k per MW, depending on volatility and depth. Ancillary services showed slightly greater upside, with FCR topping out at €10k per MW and stacked aFRR capacity reaching €17.6k per MW. Even aFRR energy (PICASSO) activations – relatively subdued since May – held steady at €13.5k per MW.

In this slightly more attractive environment, the suena Energy Trading Autopilot achieved a trading revenue of €20.9k per MW, a 9% increase over July, while simultaneously reducing the average number of daily cycles from 2.12 to 1.93. By market standards, this may not sound exceptional. But compared to static strategies, the outperformance was striking: relative to the stacked spot strategy, the Autopilot delivered 32% higher revenues. Against FCR alone, the outperformance reached 108%, and even against aFRR capacity services, gains ranged from 18% to 61%. Compared to single-market optimization, the margin stretched up to even 146%.

Where August Differed

So, what changed in August? Not much, yet enough to offer more breathing room for battery optimization. The number of negative price hours jumped from just 12 in July to 64 in August, restoring more frequent charge opportunities during midday solar peaks. At the same time, solar output climbed nearly 10%, reintroducing some of the volatility needed to unlock intraday spreads. While wind output softened slightly and demand eased, these shifts helped rebalance the timing and depth of arbitrage windows.

Ancillary services also became more attractive, particularly on the aFRR down side, where capacity prices increased by roughly 20%. None of these changes were dramatic. But together, they widened margins just enough to reward strategies that could respond across all products and timeframes.

Coordination Over Spikes

In many ways, August echoed the dynamics of July – a market shaped less by dramatic peaks and more by the steady return of known patterns. It was defined by the ability to capture value steadily – wherever it appeared. For storage operators, that meant coordinating across markets and timelines, staying flexible, and adapting as signals evolved. But unlike July, August brought a bit more movement: more midday volatility, a broader spread of ancillary signals, and the reappearance of negative pricing hours. None of these trends were pronounced on their own, but together, they created more attractive opportunities.

However, the performance gap between static and adaptive strategies widened – not because the best strategy found the biggest price spike, but because it captured the most value consistently, across the curve. That kind of coordination isn’t easy. But it’s precisely what defines operational maturity in merchant battery storage. And it’s exactly, where multi-market optimization shows its true value: not in picking a single winner, but in aligning assets across all relevant products. In such environments, this kind of operational coordination can be the difference between average results and standout performance.

Come Fall, Come Rise?

As autumn begins, system dynamics are likely to shift once more. Wind generation typically increases, demand rises, and volatility often returns – especially in the evening peak and overnight hours. That doesn’t guarantee bigger margins. But it does suggest a more dynamic optimization environment, where responsiveness, again, will be the defining advantage.

About the author:

Dr Lennard Wilkening is co-founder & CEO of suena energy, a green energy marketer for battery storage and renewables. suena offers marketing solutions that enable profit-maximizing multi-market trading and implement them through powerful trading algorithms. Lennard holds a PhD in grid-oriented use of battery storage systems from the Technical University of Hamburg and has more than nine years of experience in battery storage optimization and energy trading.