Day-ahead European electricity market switches to 15-minute intervals

The major switch from 60-minute blocks to 15-minute intervals in the European market was originally scheduled to take place on June 11 but not all market participants reported readiness in time.

The transition in day-ahead trading on the European power exchange (EPEX) Spot market to 15-minute intervals is no trivial matter and required some lead time. As of yesterday – Sep. 30 – the time has come, as EPEX Spot confirmed in a press release in mid-September.

Trading was due to take place in the new time frame for the first time yesterday, with the corresponding first-day deliveries occurring today.

The change marks “a true paradigm shift for the energy transition,” said Jörg Seidel, head of short-term asset optimization at energy company Vattenfall. Jannik Schall, co-founder and chief product officer of 1Komma5°, said that with 15-minute pricing, “the market reflects reality much more accurately.” Green electricity trader Luox Energy (part of the Lumenaza electricity trading platform) called the move a “milestone for direct marketing – especially for photovoltaic systems.”

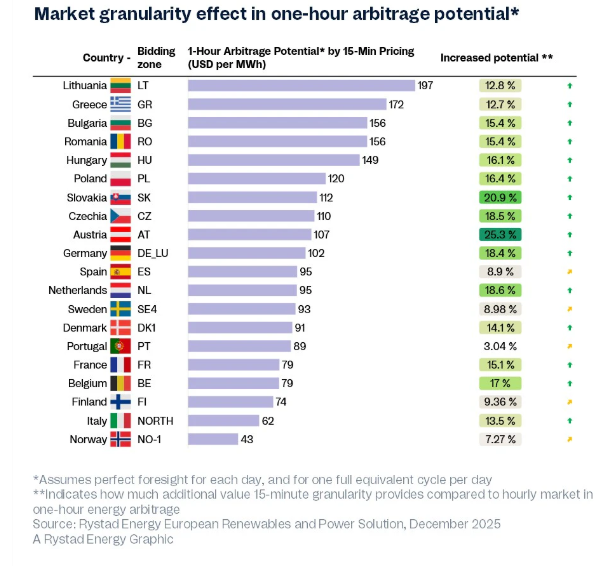

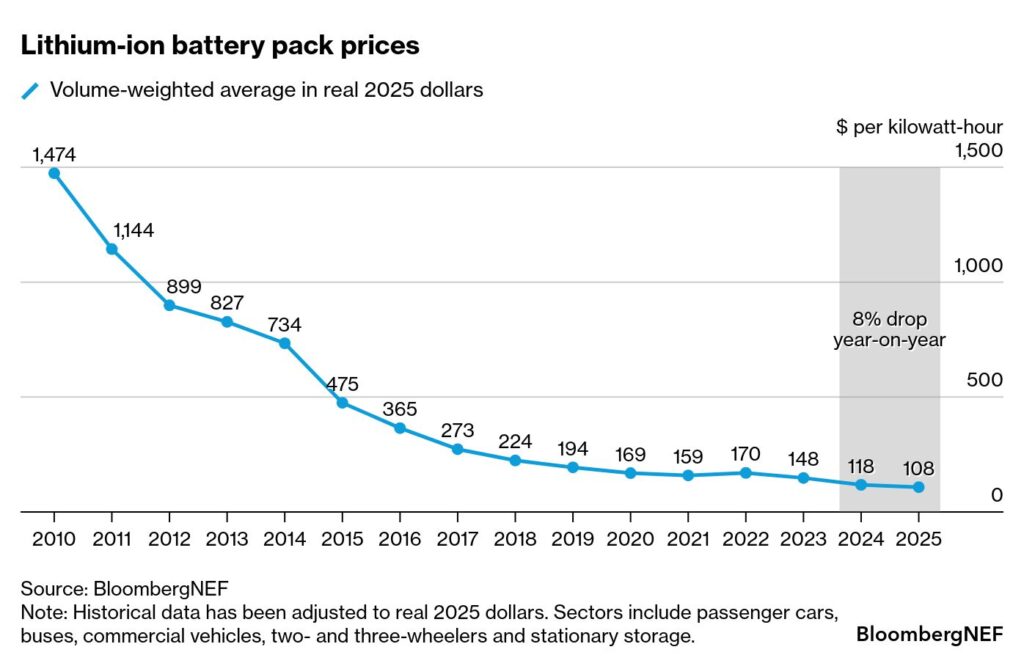

There is widespread agreement quarter-hourly pricing benefits renewables in particular because it better reflects their electricity production profiles. The industry also hopes the transition will bring positive momentum for the marketing of battery storage systems. Load- and energy-management systems, as well as dynamic electricity tariffs, could also become more attractive.

The change is due to a European Union requirement all European electricity markets use 15-minute settlement periods. In short-term, “intraday” trading, quarter-hour blocks have been available since 2011, in addition to one-hour intervals, with transactions possible up to five minutes before a respective interval. With the day-ahead market determining prices for the following 24 hours at noon each day, 60-minute blocks on the EPEX Spot meant direct marketers had to prepare feed-in forecasts for solar power on an hourly basis. Since actual generation can change within an hour, deviations had to be offset with intraday trading. Naturally, there will still be no absolutely accurate forecasts but direct marketers hope the shorter intervals will reduce such “ramp costs” and result in higher revenues for their customers.

“Production and demand can now be mapped much more accurately,” said Vattenfall’s Seidel. “In the future, production forecasts can be submitted more precisely, electricity from wind and solar energy can be marketed even more precisely, batteries and pumped storage can be used more efficiently, and flexibility in the system can be significantly increased.”

1Komma5° also highlighted the advantages of 15-minute pricing intervals for dynamic electricity tariff users. Having 96 prices determined daily, rather than 24, means “even more precise billing and more opportunities to purchase electricity cheaply when there is plenty of wind or sun available,” stated the company. Automated control of heat pumps, battery storage systems, or wall boxes is of course necessary to take advantage of the new pricing system.

As far as batteries are concerned, 1Komma5° said the pricing transition would see “more and more pronounced price peaks and troughs within a day.” That, in turn, represents more opportunities to profit from such fluctuating prices by using energy storage. It also means, of course, forecasts, trading systems, and financial products will have to work harder.

Dynamic electricity tariff provider Tibber sees advantages for its customers “both through the manual control of charging processes, or household appliances, and through automated adjustments via smart functions.” Tibber said it had redesigned the price screens on its app to offer users 15- or 60-minute viewing. The new system features a color scheme and price ring which Tibber said provide “intuitive information about whether the current price is relatively low or high over the course of the day.” The free switchover to that app layout will occur automatically and Tibber said customers who don’t have a smart meter can continue to use the company’s monthly dynamic tariff.

EPEX Spot – which said preparation for the pricing interval changeover had taken more than a year – in mid-September said it did not expect complications to arise from the transition because testing and preparations were “on track” for the original start date of June when the decision was made, on May 14, to postpone the move until yesterday. As noted, however, some market participants were not prepared for the switch at that point.

From pv magazine Deutschland.