CATL confirms significant upgrade to sodium-ion battery product range and scale into 2026

Chinese battery giant CATL has detailed a wider and larger-scale deployment of its sodium-ion battery range across multiple sectors, including battery storage.

Chinese media reports said that CATL, at its supplier conference in Ningde, Fujian province in China, held on December 28, 2025, confirmed its 2026 plans for its sodium-ion batteries (SIBs).

They include an expansion in applications to include energy storage, plus use in battery swap systems, passenger vehicles, and commercial vehicles. CATL said this potentially is the start of a ‘dual-star’ approach, creating a new trend of “sodium and lithium batteries shining brightly together.”

Earlier in 2025, CATL unveiled its Naxtra sodium-ion brand with two types of products, translated as “Sodium New Power Battery” and “Sodium New-24V Heavy Truck Start-Park Integrated Battery,” which aimed to provide a passenger car with a complete battery, and trucks with a rugged 24V starter battery. The key advantages when presented were operational temperatures ranging from -40 °C to 70°C, supporting both deep winter operations and very high summer peaks in regions where traditional batteries have not been viable, or struggled with heating or cooling requirements.

CATL stated that its SIBs achieved an energy density of up to 175 Wh/kg, and could support a range of 500 kilometers in standard passenger-vehicle applications for its 2026 range.

Outlet IT-home also detailed previous investor relations activity from CATL, where on October 20, it suggested that sodium-ion batteries offer, aside from a wider temperature range, both a superior carbon footprint and safety, making them widely applicable in passenger and commercial power applications.

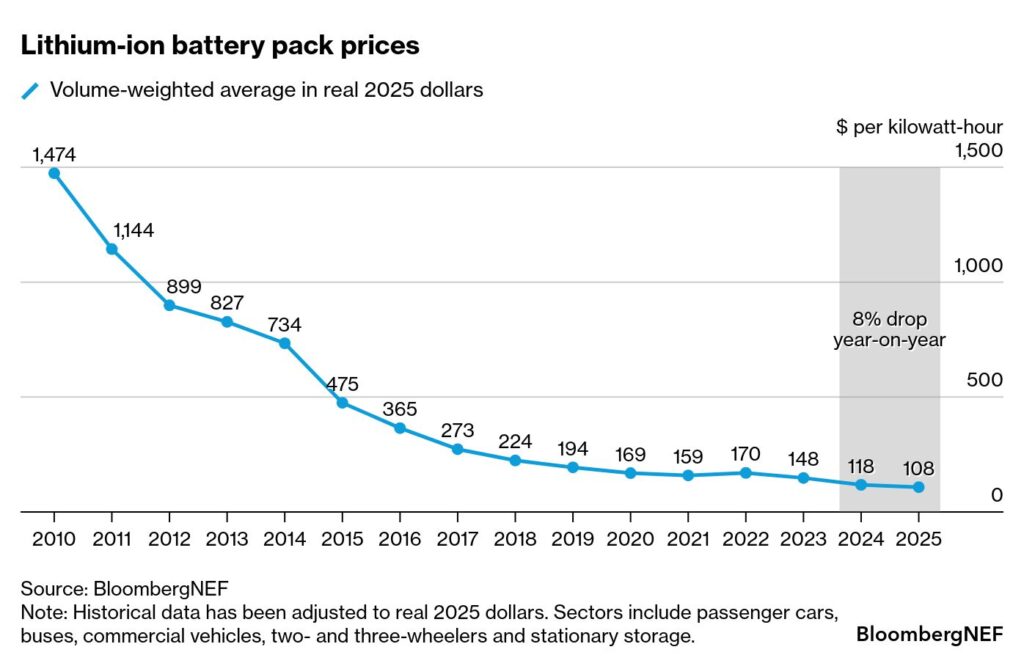

A recent report from the International Renewable Energy Agency (IRENA) suggested that sodium-ion battery cell costs could drop to $40/kWh, while also cautioning that SIBs will likely supplement LIBs in some ways, noting that future capacity deployment remains unclear, with challenges relating to ensuring sufficient demand and a robust supply chain. The price of lithium and component materials in battery types such as lower-cost lithium iron phosphate (LFP) batteries is also a factor – a BloombergNEF report this month suggested LFP battery pack prices for stationary storage fell to new lows in 2025, as far as $70/kWh in 2025, 45% lower than in 2024.