Volta’s 2025 Battery Report: Costs keep falling, boosting BESS across the globe

The Volta Foundation has published its annual Battery Report for 2025, now stretching to a mammoth 750 pages, featuring data and work from 120 battery experts from over 90 institutions.

The report, which includes coverage of the global battery industry across EVs, stationary storage, and multiple other battery use-cases, from supply chains, to manufacturing, to R&D, and more.

Battery energy storage systems (BESS) go beyond 100 GW in a year

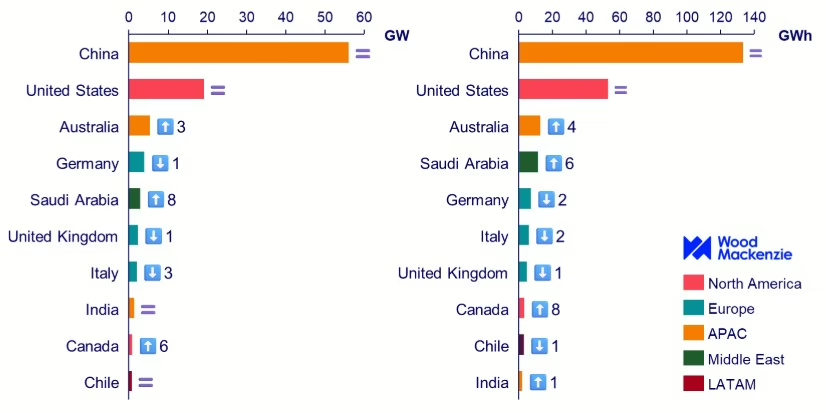

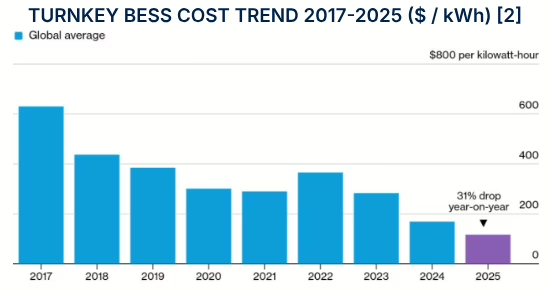

The 2025 report notes that BESS deployments increased by 104 GW / 257 GWh, for a global capacity of 267 GW / 610 GWh, breaking the 100 GW barrier for the first time. Some 40% of the cumulative BESS capacity was installed in 2025 alone, and costs were noted as falling 31% year on year.

With a significant pack of charts in the detailed report, a useful first stop is the top 10 countries by BESS deployed capacity in 2025 (GW and GWh):

The complete dominance of China, the US holding steady, and rise of Australia, Saudi Arabia, and the emergence of Canada are all noteworthy. The UK’s now more mature market showed less growth but remains one of the world leaders overall.

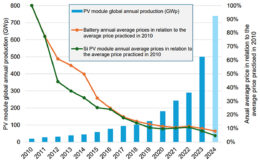

Data from the report, provided by BloombergNEF to Volta, shows turnkey BESS (which includes all battery and electrical assets and management software) costs fell another 31% from 2024 to 2025, at $117/kWh, a number reached by weighting the global averages. This is almost 70% down since 2022, and as the report notes, it means in 2025, the same CapEx would have built a system three times the size in MWh of a 2022 system.

The report also noted that costs in China are as low as $63/kWh when compared to Europe’s $120/kWh.

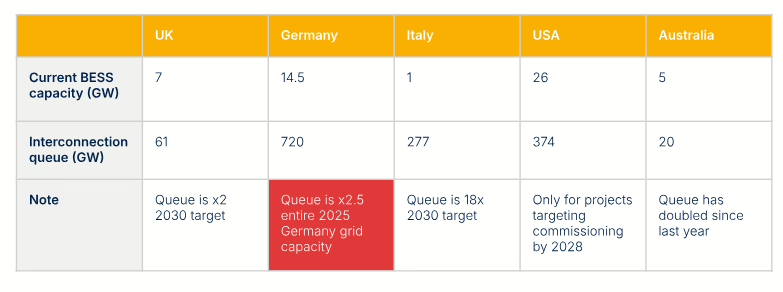

Another useful slide shows the growing problems with projects and grid connection/interconnection waiting times in various countries, with Germany highlighted for its extended queue:

LDES

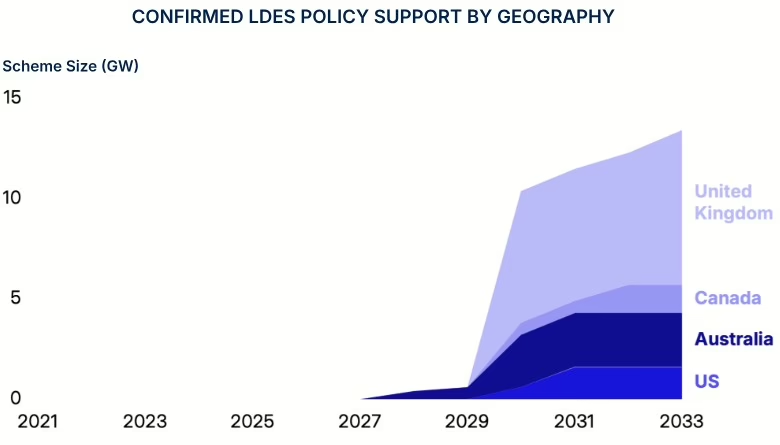

The report also detailed the current atmosphere of support and expecations for long-duration energy storage (8 hour duration and beyond), noting that policy remains critically important for projects to reach a final investment decision. The report noted only 0.5 GW of LDES projects are operational outside of China, and lithium-ion based projects comprise much of project pipelines.

LTSAs

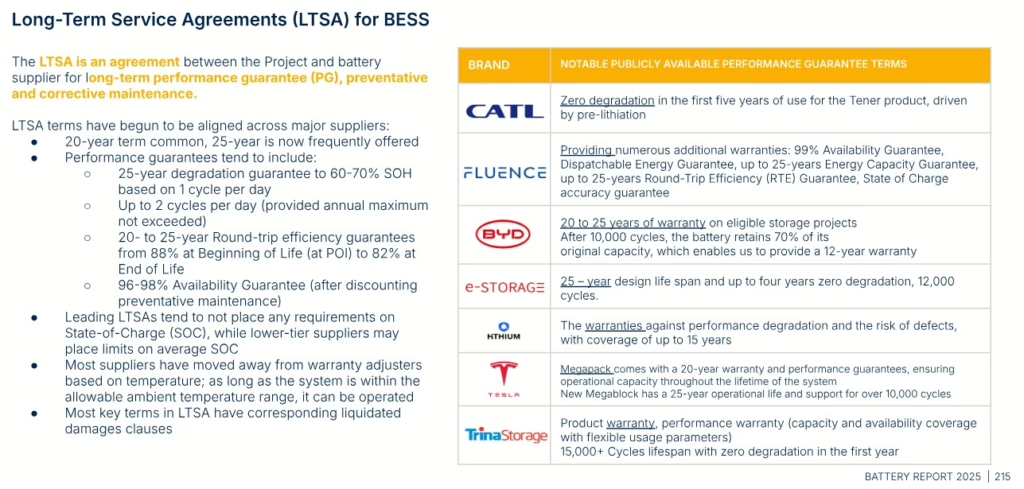

Another compelling page of the report is on pp 215, offering detail of different manufacturer Long-Term Service Agreements (LTSAs) and how they differ between suppliers on their products, including CATL, Fluence, BYD, e-Storage, Hithium, Tesla, and TrinaStorage.

The report notes that 20-year terms are stretching more to 25-year terms, with a 25-year degradation guarantee for between 60-70% SOH based on 1 cycle per day, or 2 cycles per day provided a maximum figure annually is not exceeded:

R&D focuses

Touching on research and early commercialization activities in the battery space, the report details on three distinct trends, while noting that the lithium iron phosphate battery (LFP) has become largely mature, with few cost savings breakthroughs expected.

Elsewhere however, the three trends are:

Sodium-ion (Na-ion) technology has matured enough to move into early commercialization as the stationary storage market has seen, with projects live in multiple regions including Switzerland, China, and the US.

Regarding anode materials, while graphite remains the standard, graphite-silicon blends are emerging. And, the industry is seeing a shifting focus from silicon oxide (SiO) toward silicon-carbon (Si-C) solutions, which has been seen in small-scale batteries.

And, on the third point, the timelines for deploying All-Solid-State Batteries (ASSB) remain distant, but the industry is increasingly coalescing around sulfide-based architectures as the most viable mainstream path forward.

The 2025 Battery Report is available digitally at https://volta.foundation/battery-report-2025. As has been the case in the past, a fully downloadable release will follow later in Q1 2026.