The business case for C&I storage

Most decision-makers (CFOs, COOs, energy managers) are comfortable with solar’s passive, intuitive value proposition: generating onsite, offsetting grid consumption, and savings per MWh.

Batteries, by contrast, are active assets. Their returns depend on how intelligently they are operated on tariff structures that reward flexibility, and on access to electricity markets where revenues fluctuate daily. As a result, many decision-makers still lack confidence in whether the business case is reliable.

At the same time, project developers and energy service companies are still focusing on selling the technology, rather than articulating the battery’s value in the language of the customer’s challenges (energy cost, resilience, capacity limits, or sustainability objectives). Until that communication gap is closed, market hesitation will persist.

Value stack

C&I battery economics depend on a stack of overlapping value streams that vary by country, network area, and even by site. Tariff structures, network charges, and flexibility market access differ across Europe. In one market, peak shaving and network charge avoidance may drive most of the value, while in another, participation in frequency response programs could dominate.

This complexity creates a steep learning curve for developers and investors who must navigate a patchwork of rules and tariffs. Even when a value stack model looks strong on paper, projects often stall in delivery. Integrating the energy management system (EMS), which controls the battery, and aligning responsibilities between site operators and aggregators are non-trivial tasks. If the EMS cannot actually implement the tariff or market-optimized dispatch strategy, the modeled returns remain theoretical.

Bankable batteries

There is growing policy support for flexibility across Europe. Countries are reforming network tariffs, introducing dynamic pricing, and lowering market-entry barriers for behind-the-meter assets. Independent aggregators are being allowed to compete directly with traditional suppliers, while sub-metering and verification standards are improving. These reforms are making it easier to monetize C&I batteries with flexibility. The two broad channels are implicit flexibility (cost savings) and explicit flexibility (market revenues).

Implicit value covers self-consumption optimization with shifting time-of-use so the battery is charged in cheap periods and discharged in expensive periods, and/or enabling a switch to more cost-effective tariff options. It also includes peak-shaving to avoid demand charges during high-use periods, and network cost optimization to avoid high-priced network tariff periods.

Explicit value covers grid services where the battery is participating in frequency response or local flexibility markets, and wholesale trading on day-ahead and intra-day markets.

This complexity means the EMS has a critical role to play. A robust EMS must be able to:

- Forecast site load and generation to anticipate demand and solar output with enough accuracy to plan optimal dispatch

- Optimize in real time to continuously adjust to changes in consumption, weather, or pricing signals

- Ingest and act on tariff data – whether time-of-use, dynamic, or complex demand-based tariffs

- Interface securely with aggregators or market platforms to participate in grid services

The most advanced C&I batteries now ship with EMS platforms capable of performing these tasks natively, using AI-based forecasting and dynamic optimization. But many systems on the market still rely on basic charge/discharge logic or manual scheduling.

For investors, energy solution providers, and buyers, checking EMS capability should be part of technical due diligence and partnership screening.

Future modeling

For investors in behind-the-meter battery portfolios, aggregators and optimizers, it is important to understand not only the value stack today, but the future value of flexibility. This includes taking into account wholesale and retail electricity price volatility, tariff reform, ancillary service evolution, and even battery duration – 1.5-hour and longer hour systems capture different portions of the value stack.

Forward-looking modeling lets developers and financiers stress-test project economics: how does IRR change if volatility halves, or if network tariffs are restructured? These analyses are crucial for securing finance, designing revenue-sharing contracts, and selecting the right EMS and aggregator strategies.

C&I solutions

Early adopters of C&I batteries are those with the highest energy costs, tightest capacity limits, or strongest resilience needs. Sustainability credentials are a bonus. Typical customers today include:

- Manufacturing and industrial sites where heavy power users face high demand charges, or where battery storage reduces contracted capacity and provides backup and voltage stabilization support.

- Transport and logistics hubs, such as EV depots, airports, and ports using batteries to smooth charging peaks and defer costly grid upgrades.

- Data centers and hospitals, where extending UPS capability into grid-connected storage creates both resilience and new revenue.

- Retail and supermarkets, since refrigeration loads and rooftop PV make batteries ideal for peak shaving and self-consumption.

- Public estates and campuses, where municipalities, public sector healthcare facilities, and universities can use batteries to cut peak tariffs and as part of a wider bundle of energy-saving and decarbonization measures (e.g. via an energy performance contract).

Adoption will cascade to SMEs (hotels, mid-sized warehouses, and office parks) as battery investment costs come down further, aggregation models and tariffs mature, and financed “battery-as-a-service” offers grow.

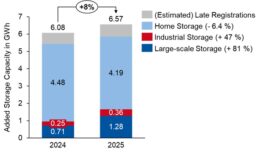

According to LCP Delta’s C&I Battery Market Outlook, the market will experience strong growth out to 2030 in Europe, with top markets including Germany, the United Kingdom, the Netherlands, Sweden (though a reduction from its peak in 2024), Spain, and France.

Battery technology is ready, control intelligence is maturing. Now it’s time for confidence in the economics to catch up through proper value stack modeling, for strategic targeting of key customer segments, and developing and communicating the right value proposition to end-customers.

About the author

Dina Darshini is head of commercial and industrial at LCP Delta, where she also leads research on behind-the-meter solar and batteries. Her core areas of expertise include distributed power, energy services, technology deployment forecasting, due diligence, and competitor analysis.