Digging into how BESS assets actually trade: ‘Making BESS happen’ white paper spotlights market integration

While battery storage developments are often framed in terms of megawatts and megawatt-hours, a battery energy storage system (BESS) doesn’t generate revenue just from nameplate capacities and a grid connection. A new white paper from energy trading consulting group Forrs, titled “Making BESS Happen, Turning Energy Storage Potential into Grid-Scale Reality,” helps detail how a BESS earns revenue after commissioning and how an asset actually plugs into trading systems and markets.

The sector devoted to software and tools that maximize the profitability of BESS (broadly known as optimizers) remains one of the most competitive and active, with many companies continuing to develop expertise both in their home regions, while expanding to other regions with different rules as well. Another busy and competitive sector focuses on battery analytics, as operators and owners seek to best understand and measure their assets to control them. Together, both are increasingly useful for maximizing revenues, but the picture for how this happens isn’t always clear.

The Forrs paper focuses on BESS and details trading architecture, energy markets (with a focus on Germany), multi-market trading, revenue stacking, and more, as market rules and financial models turn the flexibility of a battery into revenue.

An asset in the hand…

In simple terms, the paper states early on that batteries behave less like passive infrastructure and more like continuously traded assets. Revenue depends not just on market access, but on how operational data, optimization software, and trading systems interact in real time.

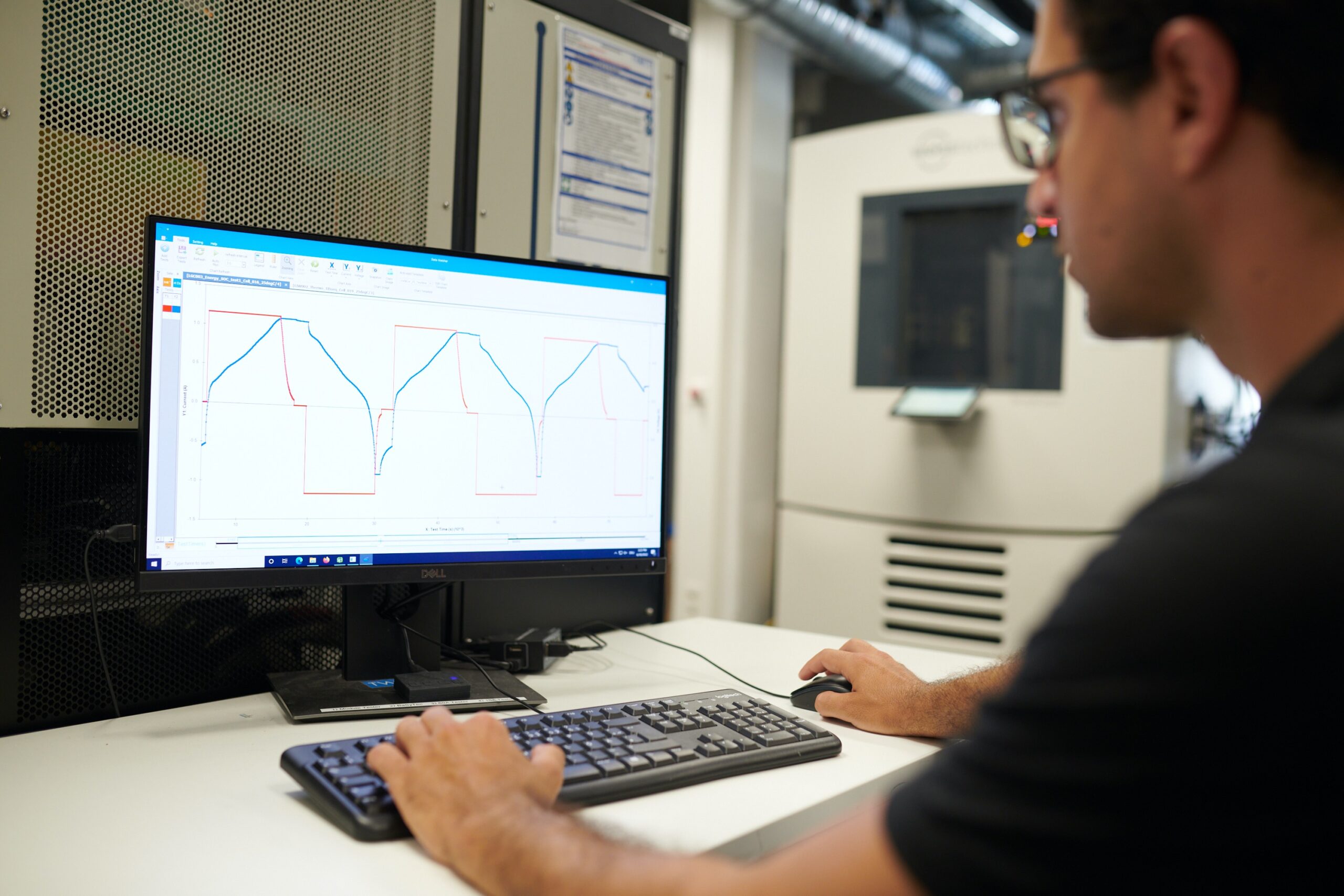

That dependency on data is not theoretical. A recent survey of 117 operators by battery analytics firm Twaice found many struggle with access to performance data, inconsistent supplier reporting and limited accountability when assets underperform. Twaice CEO Stephan Rohr noted that the problem is not a lack of data, “but the difficulty of turning that data into insights teams can trust and act on.”

In practice, that makes automated optimization harder and increases reliance on conservative trading strategies, as, unlike wind or solar, dispatch decisions directly affect future revenue potential, not just current output.

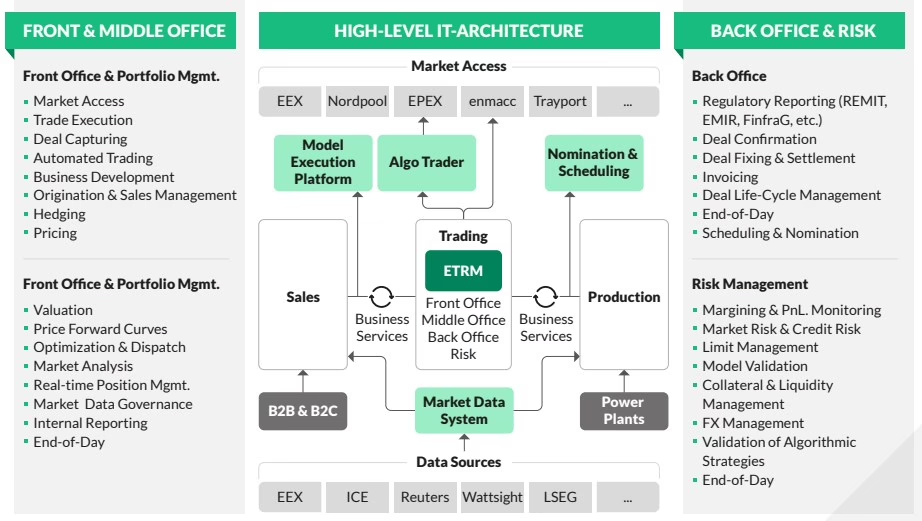

In the paper, Forrs breaks down the trading stack or architecture required for battery assets, spanning the operational telemetry, state-of-charge optimization, degradation-aware dispatch and energy trading and risk management systems. This is a balance of data from the BESS Energy Management System (EMS), other analytics tools, and the communications aspects of connections with transmission system operators (TSOs) and

other market participants.

Quote: “At the center of the architecture lies the optimization engine, which synthesizes market signals, asset constraints, and operational forecasts to generate actionable trading decisions. The optimization engine encounters maximum complexity when a battery participates concurrently in both ancillary services and wholesale markets. It must dynamically allocate capacity between different market segments while respecting technical constraints and regulatory requirements. This requires sophisticated algorithms that can balance profitability with grid-supportive behavior, often under tight operational timelines.“

A high-level diagram in the paper of a trading house or department shows the complexity of data sourcing (and options), market access and platforms, trading setups, sales, and support from all sides of the office.

Markets are all alike, but all markets are different in their own way

Germany provides the main case study in the paper. Operators must navigate day-ahead and intraday markets alongside ancillary services, each with distinct timing, qualification rules and risk profiles. Revenue stacking depends on deliberate allocation across these layers, with the backing for the decision best coming from data and fast decision-making through algorithms or trader expertise.

In stark contrast is one of the world’s biggest battery markets in ERCOT, otherwise known as Texas’s grid. ERCOT in Texas operates an energy-only market with no central capacity market. Revenue is driven by scarcity pricing, ancillary services and volatility. Batteries in ERCOT often chase real-time spreads and ancillary services, with price caps far higher than in most European markets, most of the time. In practice, this means a big battery in Germany would operate with careful segmentation and multi-market optimization, while in ERCOT, the grid rewards volatility capture and fast response under scarcity events.

Revenue stacking meets reality (and the banks)

The white paper also flags a tension familiar to lenders around the lifespan of a BESS asset. Aggressive cycling can lift short-term revenues and take full advantage of early profitable opportunities, but this may accelerate degradation or risk warranties provided by the battery manufacturers. Financial models from lenders depend on performance histories that are auditable and defensible. The paper notes that best-in-class aging-aware models consider degradation to be part of the optimization problem, and models such as digital twins may help identify expected aging through natural or “calendar” degradation, and that from cyclic aging.