BBDF 2025: Merchant vs. contracted strategies

Europe reached 18.5 GWh of battery capacity in 2024 and is set to reach around 50 GWh, said Antonio Arruebo, a market analyst at SolarPower Europe, during a panel at BBDF 2025 in Frankfurt, Germany.

At the end of 2024, the U.K. was still the largest battery storage market in Europe with around 8.7 GWh, followed by Italy with 3.8 GWh, Germany with 2.3 GWh, Ireland with 1.6 GWh, and France with 0.9 GWh.

Arruebo also explained that in all of these markets, project developers and investors can opt for a merchant or a contracted strategy, although lenders seem to be more comfortable with the latter.

“We have the luxury of being present in all major markets, including the U.S. and Australia,” said Martin Daronnat, head of flexibility and structured origination at Engie. He described the German market as “extremely” hot. “However, we have to be highly cautious,” he added. “The future is bright but not as bright as everyone hopes. Risk management remains a complicated matter.”

Daronnat also explained that lending banks pay close attention to who will operate the assets. “They take a very critical look at who is running the battery,” he said, noting that physical and virtual business models create a smaller gap on creditworthiness compared to purely financial models.

According to Daniel Schwarz, head of business development for customers and flexibility at Vattenfall Energy Trading, tolling and merchant approaches are becoming more frequent in European storage markets. However, he said, clear, long-term deals provided by regulated environments could prevail over the next 10 years.

“Reasonability will kick in and proof-of-concepts will be exported across markets,” he said. “After tolling, I see further granularity coming. For example, August 2029 will be a starting point for Germany, which will require more engagement with DSOs.”

“Everything will become more sophisticated and grid constraints will increase significantly,” said Steffen Schülzchen, CEO and founder at Entrix, an AI optimization and trading platform for grid-scale battery storage. “The battery itself doesn’t do anything, and with increasing market risks, surgical precision will be needed in managing a storage asset.”

He also believes that tolling may not be the only option in markets without strong regulatory support. “There is space for fully merchant projects in Germany, for example,” he said, noting that in emerging markets, however, getting a fair price is difficult.

Joshua Murphy, head of storage at Econergy, said his company, as an independent power producer, needs to have different approaches in different markets. “The key to entering a market is that we are happy with its fundamentals and flexibility,” he explained. “In Germany, we are actively looking for more projects and we believe we can make really nice revenue.”

“The German market ensures less flexibility than the U.K. market,” Murphy went on to say. “But it still offers a lot of options.”

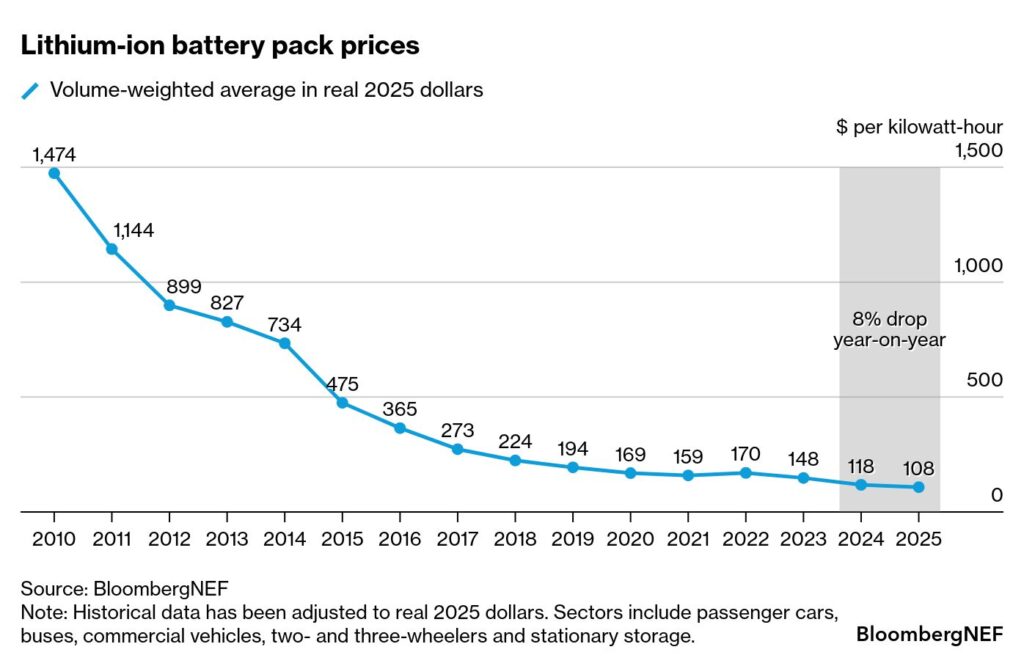

He warned, however, that banks carefully consider the degradation profile of the battery, other key metrics, and the expected drop in efficiency.

“The market will be there, although there will be volatility,” he concluded. “But the brave developers will take that risk. Eventually, the market will come with you, if the fundamentals are there.”