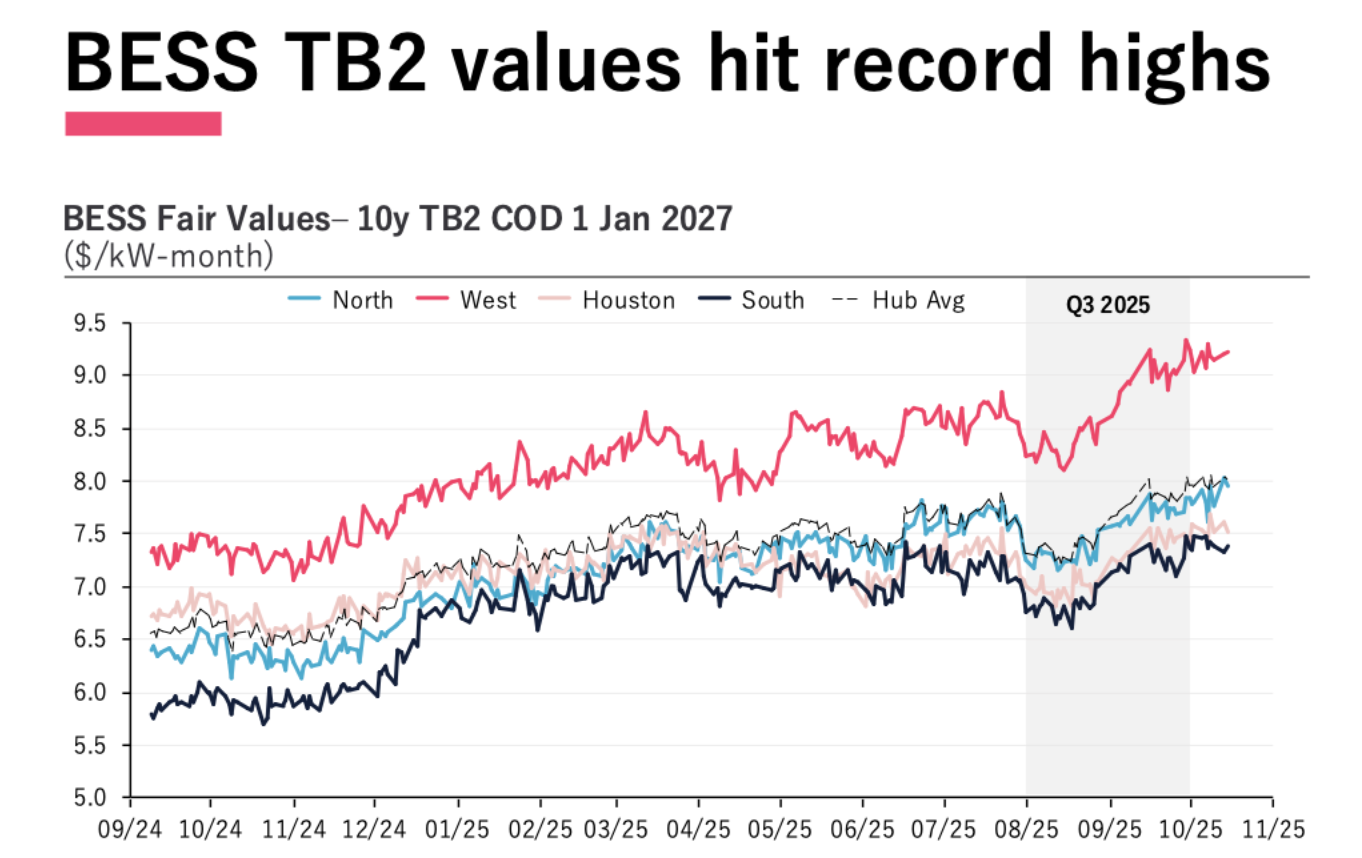

Battery storage values reach record highs in ERCOT, Pexapark finds

ERCOT investors are increasingly pivoting toward battery storage as the One Big Beautiful Bill (OBBBA)-driven policy shifts and rising project costs put growing pressure on solar and wind power purchase agreements (PPAs). Swiss-based analytics firm Pexapark is seeing this play out clearly in the market: forward values for BESS are hitting record highs, while solar and wind PPAs face an increasingly widening bid-offer spread.

With BESS in ERCOT now relying on energy arbitrage for the majority of their revenue, Pexapark reports that the arbitrage opportunity over the next ten years advanced by double digits in three out of four ERCOT hubs compared to the same quarter last year. Following a lengthy period of underperformance, this finding points to an increasingly bullish view of BESS over the long-term as load growth and renewables penetration continue to widen intraday spreads.

At the same time, BESS toll offers stayed mostly flat or declined. This convergence – rising value levels combined with competitive, stable offer pricing – points to a potentially growing opportunity in BESS dealmaking, Pexapark notes.

“Expected load growth coupled with high levels of solar penetration mean that intraday spreads in ERCOT will, in general, get wider, with consistent midday dips and increasingly prominent shoulder hour spikes. This dynamic strengthens the long-term economic rationale for BESS even if recent summers saw decreased levels of price volatility,” said Yaniv Yaffe, Pexapark product manager.

Despite market volatility and a 60% year-over-year revenue decline in the first half of 2025, Modo Energy finds projects can still be profitable and meet investor return thresholds, particularly with favorable locations, duration (2 hours+), and offtake agreements.

Therefore, BESS buildout in ERCOT shows no signs of slowing down. According to Modo’s recent reports, a record 2 GW of battery energy storage capacity began commercial operations in ERCOT in Q3 2025, marking the market’s largest deployment of battery capacity in a single quarter. ERCOT’s operational battery capacity has now reached 12,052 MW in rated power and 19,442 MWh in energy capacity.

Solar and wind PPAs, in contrast, have experienced a more difficult market environment since the passage of the OBBBA. While a 7% rise in the forward market drove the fair value of wind and solar PPAs higher in Q3, offer prices for such contracts rose even more: 12% for wind PPAs and 13% for solar PPAs, Pexapark finds.

The result is an increasingly illiquid PPA market. Pexapark tracks only three ERCOT PPAs which were publicly announced in Q3, representing fewer than half the number of deals signed in the same quarter last year.

The higher offer prices for wind and solar PPAs reflect an increasingly hostile regulatory environment. The OBBBA is phasing out billions in clean energy tax credits by mid-2026 while imposing strict sourcing restrictions on Chinese components. Although safe harbor provisions were preserved, the narrow compliance windows are straining developers and pushing up project costs.

“The ERCOT market is facing temporary but acute policy-driven shocks that have created a pricing gap between project costs and buyers’ willingness to pay. For wind and solar, the price gap is now significant and is contributing to the shift in focus toward BESS,” said Luca Pedretti, COO & co-founder of Pexapark.