European battery storage fleet expected to grow 45% year-over-year to 16 GW in 2025, WoodMac says

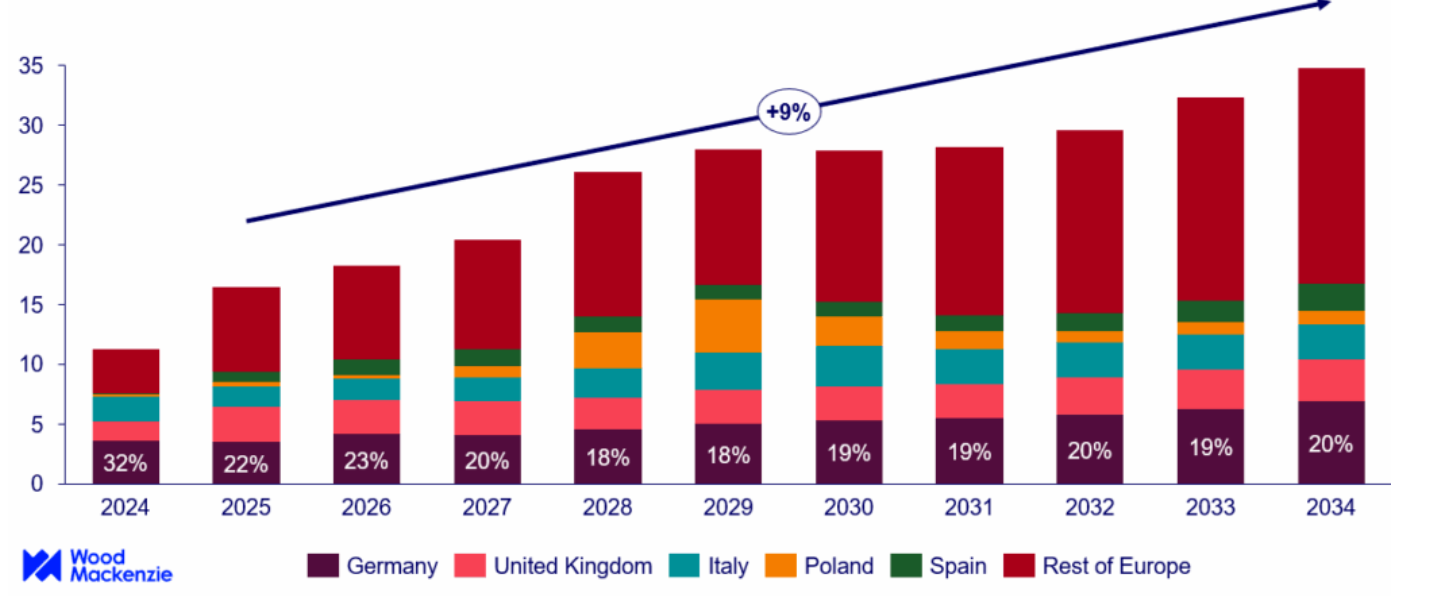

Europe’s BESS market is poised for a major jump in yearly additions, with deployment hitting 11 GW in 2024 and projected to surge 45% to 16 GW in 2025, according to Wood Mackenzie.

Moreover, the research and consultancy firm expects European BESS deployment to grow at a 9% compound annual growth rate over the next ten years, reaching 35 GW by 2034.

Within this expanding European landscape, Germany emerges as the rising star across all segments (utility, C&I, residential). The country leads European deployment with over 3.5 GW expected this year, doubling to 7 GW by 2034. However, despite strong current fundamentals, the German market faces revenue decline as increasing competition cannibalises price volatility.

As previous reported by pv magazine, Germany’s BESS connection requests have ballooned. German Association of Energy and Water Industries (BDEW) recently surveyed the four transmission system operators and 17 distribution system operators and found that there are currently pending grid connection applications for large battery storage systems (≥1 MW) totaling more than 720 GW. Grid connections for an additional 78 GW have already been approved.

Now, Wood Mackenzie reports that at the beginning of the year there was around 300 GW of connection requests for BESS across Germany, now already exceeding 500 GW, pointing to major grid connection challenges ahead. The utility-scale BESS segment represents 35% of Germany’s storage outlook, totalling 18 GW of BESS demand over the ten-year period. An additional 8 GW comes from commercial and industrial applications, according to the research firm.

As Europe’s largest power system, Germany is facing a growing capacity crunch with major implications for grid operators and investors. Nuclear generation has been fully phased out, and around 29 GW of coal capacity is expected to retire by 2030. New gas generation projects are struggling to materialize, while a capacity market looms on the horizon. These factors create significant challenges for energy shifting, ancillary services, and overall security of supply—needs that residential BESS alone cannot meet at GWh scale.