Sungrow’s Brazilian business is heating up for batteries as solar project demand cools

In a challenging year for large, distributed solar generation projects – between 1 MW and 5 MW in scale and often developed in clusters – and for centralized photovoltaic plants, inverter supplier Sungrow experienced a decline in orders.

That has been balanced by new business for Sungrow’s storage products, including pre-agreements for the LRCAP capacity reserve auction for batteries.

An extension of the deadline for centralized generation sites to begin commercial operation – with associated incentives protected – has also generated new business for Sungrow but the inverter maker expects 2 GW of equipment sales for centralized generation this year, down from almost 3 GW last year, according to Brazil Country Manager Rafael Ribeiro.

“The short-term outlook is still quite challenging,” he said. “We heard an investor here at the [Intersolar 2025] fair say, ‘I have to put money out of my pocket every other month. Every other month. I’m getting cut by 30% [of potential generation]’.”

Business remains, however, with Ribeiro telling pv magazine, “We sold a project this year in Mato Grosso do Sul and many projects connected to the distributor’s grid, which ‘escape’ the ONS [Operador Nacional do Sistema Elétrico], which has been hampering operations. They are more challenging, smaller, but they are still happening, both in self-production and through PPAs [power purchase agreements] in the free market.”

Provisional Measure 1.212, which extended the start-up deadline for incentivized central-generation plants, also helped close new deals for Sungrow. “Projects must now submit inverter and module contracts by October,” said Ribeiro. “So we’ve been selling to these projects as well. We’ve already signed around 1.8 GW but it’s for delivery in 2028.”

Distributed generation

Sungrow expects to make around 750 MW of sales to power plants in the 1 MW to 5 MW market this year.

“This segment saw a significant decline, which was already expected, especially due to the regulation itself, which changed for projects that requested connection starting in January 2023,” said Ribeiro. “There’s still a significant volume but this year we should deliver half of what we did last year.”

In that part of the market, Ribeiro said, the problem is not capital nor project availability but finding solar electricity users.

“The market is saturated; there are too many power plants today and there’s a lack of consumer demand for energy,” said the country manager. “Prices are still reasonable because in the distributed-generation market we’re talking about a regulated tariff of BRL 1,000 ($184), BRL 900 per megawatt-hour, so a 30% savings offer is attractive.”

With most large corporate clients – pharmacy chains, supermarkets and other retailers – having already signed up for solar, custom is being sought from individuals, said Ribeiro.

“Now this segment is moving towards the individual market,” said the Sungrow executive. “But working with individuals is more complex. One of our clients here has 10,000, 12,000, 15,000 customers, sometimes even 50,000 customers, to be able to manage a 1 MW to 5 MW plant. And each customer will require 5 kW, 8 kW for the developer to put together and make a plant viable, while racing against the connection deadline to avoid losing the project within GD1 [rules prior to Law 14,300, which are more advantageous for injecting energy into the grid]. It’s a bigger challenge. In the past, many companies would build the plant first and then allocate consumers. Now, that’s no longer possible.”

Imports have fallen 10% to the smaller plant market, served by equipment distributors, Ribeiro told pv magazine. Competition is fierce and equipment prices are low, he said, adding, “For us, as manufacturers, it’s also a challenge.”

LRCAP proposals

While the market is turning to battery storage to drive growth, the opportunities it offers are not sufficient to offset the retreat in business from large solar plants, according to the Sungrow executive. “Imagine: We’ve sold about 3.2 GW [of solar plant equipment] so far this year, compared to 2 MW of batteries,” he said.

While batteries are popular with energy users facing power supply issues, Ribeiro said more of its customers are looking into offering storage as a service.

The much-anticipated LRCAP battery reserve auction has opened up a potential new customer base for Sungrow, which has held talks with investors and transmission companies about preparing auction bids. “We’ve seen generators also looking into this but it’s still unclear,” said the Brazil country manager.

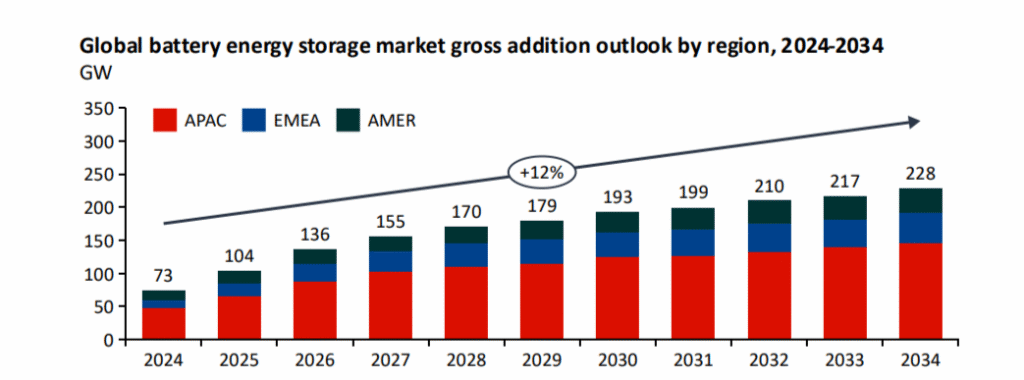

“There’s already movement in the market; everyone is looking for substations and areas to install a battery to try to make a project viable,” added Ribeiro. “Some players are very advanced and want to make deals. We’re working on them and the demand is very high. From January to June, we received 84 proposals for an auction that hasn’t yet taken place. So we can’t work with everyone; we’ll have to make pre-agreements. But again, delivery is expected in three years.”

That makes for a more complex supply chain with Ribeiro stating, “We’ve designed the model considering the price decline curve, to make the client competitive and win the auction. We’ve been working hard on this.”

Sungrow has supplied 10 GW of storage capacity in Latin America and estimates it holds a 70% market share in the region, not only via product supply but also through the provision of long-term service agreements.

“This has driven the company,” said Ribeiro. “When you buy a solar park, the inverter is key but the package value is very small. So O&M [operations and maintenance] doesn’t make sense for Sungrow. In a BESS, this represents 80% [or], depending on the connection, 90% of the business. So yes, the expertise is with Sungrow. So we’ve been providing this complete solution, including operational O&M for the customer throughout the contract term.”

From pv magazine Brasil.